Hello Readers,

This blog post is written for financially conscious young professionals who want clarity, confidence, and control over their Savings, Investment, Insurance, Retirement planning, short term and long-term goals.

Whether you start as a GET, Associate, Analyst, or Trainee Engineer , Your first salary brings independence, pride, and a sense of achievement. Yet, it also introduces an important responsibility—managing money wisely yourself.

Let us see, from awareness to action—step by step.

Are you looking for any below ?

Why Personal Finance Matters for you ?

Most Young earners focus intensely on technical skills, certifications, and career growth. Very few give the same attention to personal finance—often assuming it can be “figured out later.”

That assumption is very costly.

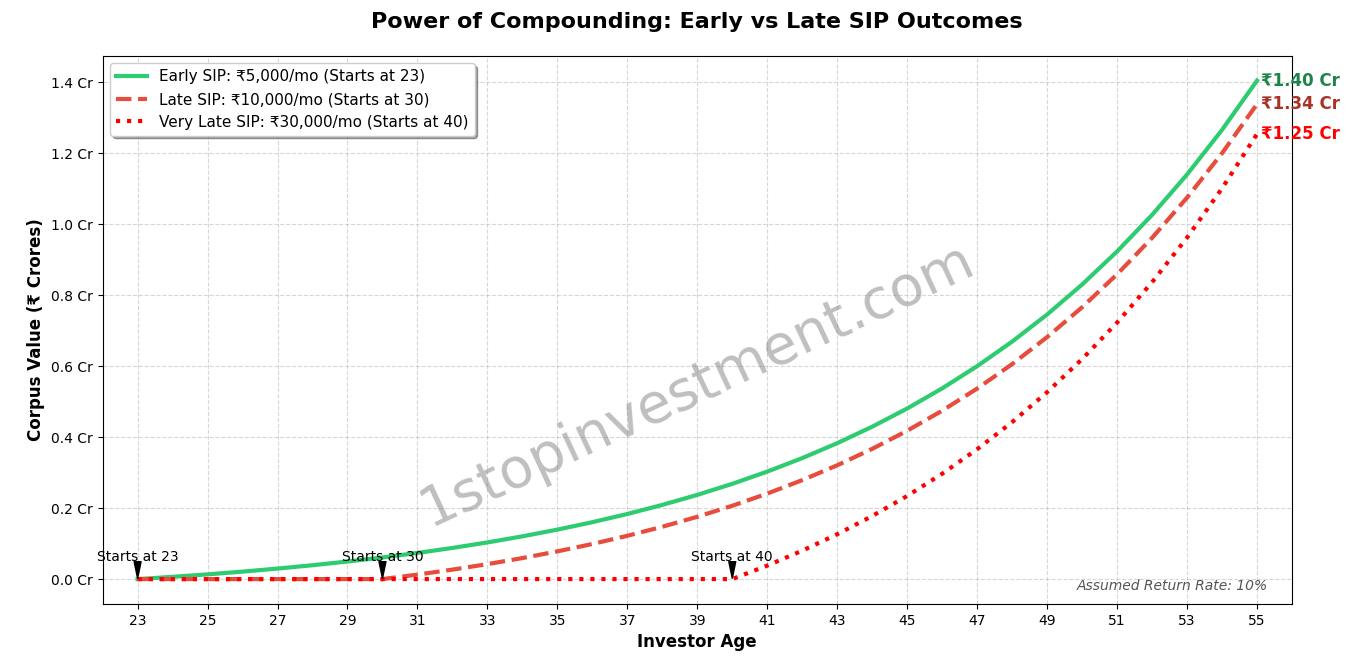

Money decisions made in your 20s have a compounding impact that no late correction can fully undo. A ₹5,000 SIP started at 22 can outperform a ₹10,000 SIP started at 30 & 30,000 SIP at 40.

Two Key Takeaway:

An investor who wants a lumpsum at the age of 55 but one starting at age 23 with just ₹5,000/month builds a larger corpus (₹1.40 Cr) than an investor starting at age 30 with ₹10,000/month (₹1.34 Cr). and age 40 with ₹30,000/month (₹1.25 Cr).

Even by investing 6 times more money per month, the late starter (age 40) cannot catch up to the early starter’s 17-year head start and invested 3 times higher as well.

Time, not income, is your biggest financial advantage.

A Reality Check: Surprising Personal Finance Statistics

Lets see some data that often surprises young earners or those who newly comes to investing.

- Over 80% of Indian salaried professionals live paycheck to paycheck, despite steady income growth (Source: NewIndianExpress Article).

- Only ~10% of Indians actively invest in market-linked instruments, while the majority rely only on savings accounts or fixed deposits (SEBI data – article).

- Less than 25% of working professionals are on track for adequate retirement, based on projected inflation-adjusted expenses (World Bank pension adequacy studies).

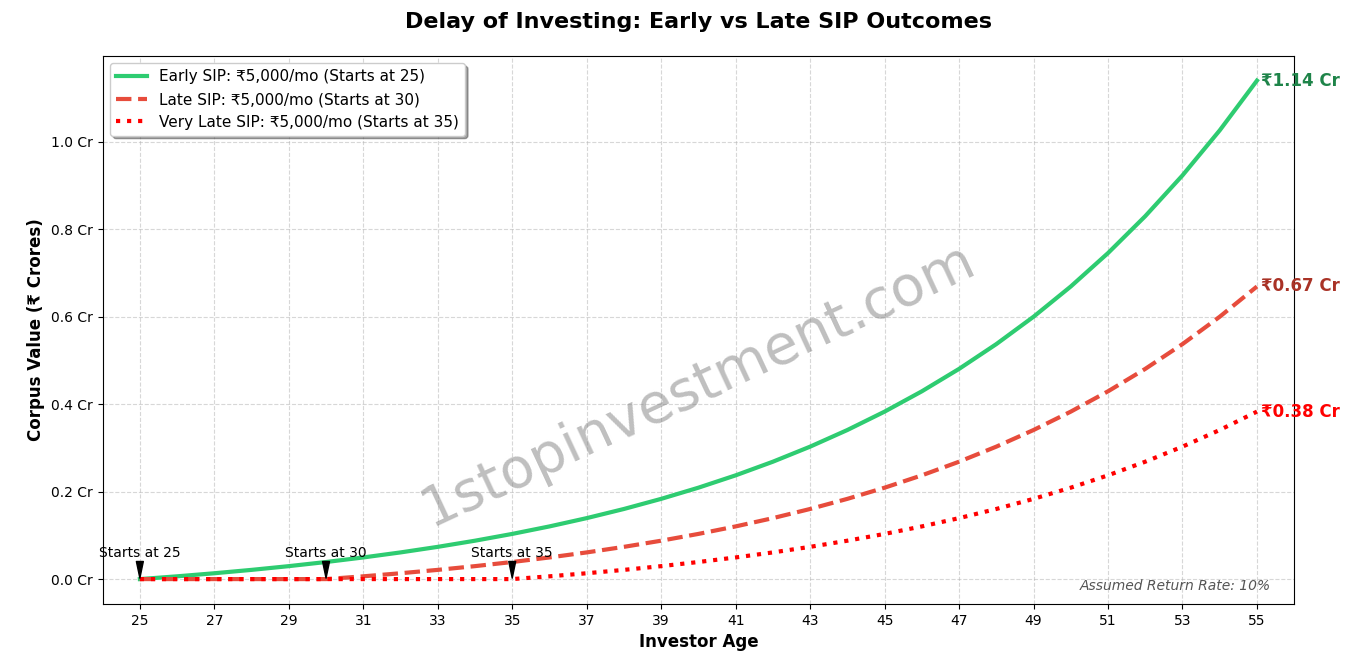

- A delay of just 5 years in starting SIP investing can reduce long-term corpus by 70%, assuming identical monthly contributions later. See below chart for more reality check.

These above illustration highlight a clear truth: Earning well does not guarantee financial security. Early Planning and action does.

Core Problem they faces :

Advantages:

As a Young Corporate earner, you typically have the following best advantages in your side:

- Stable monthly income

- Limited financial responsibilities (in case if you don’t have any dependent parents or education loans)

- High learning capacity

- Long investment horizon

Complication :

Despite the above advantage:

- Spending rises with income

- Lifestyle inflation kicks in silently

- Savings remain unstructured

- Investments are postponed due to fear or confusion

Without a system, money leaks out—unnoticed.

The Solution: A Structured Personal Finance Framework

The solution lies in building four financial pillars early:

- Savings Discipline

- Smart Investment Goal planning and SIPs

- Retirement Planning from the First Salary

- FIRE-Oriented Thinking

In the below frameworks, Let us assume few numbers to have the planning more real.

Age : 23

Monthly Take Home Salary : ₹50,000

Retirement Age : 55

Step 1: Build the Habit of Savings Before Investment

Keep your Expenses under control with maximized savings rate.

A budget is a plan for your income and expenses, ensuring every rupee has a purpose.

- Track Everything: For a few years, record all your income and expenses in detail to see where your money is actually going.

- Set a spending limit for each category and review it monthly

Savings create stability. They protect you from any emergencies. Hence, your Goal-1 is create a Emergency Fund.

Read here for a more detailed article on Emergency Fund here and its importance.

Emergency Fund Goal = 6 Months x 50,000 = ₹ 3,00,000

How do you save this amount, Simply start with 10,000 into a Liquid Fund or Create a Recurring deposit.

Read here if you want to understand on Liquid Fund and Recurring Deposits.

Step 2: Understand the Insurance

Insurance is not an optional—it is foundational to a sound personal finance planning.

Corporate health insurance provided by your employer is a strong starting point. It offers immediate coverage at low or no cost and protects your savings from unexpected medical expenses early in your career. However, corporate policies are linked to employment and may be insufficient or discontinued when you change jobs. So, preferably even for 3 lakhs or more at later age you may increase based on your needs, Please take a Private Health insurance as well. It qualifies for tax deductions under Section 80D.

Personal Term Insurance is equally important, even at a young age. Term insurance ensures your family is financially protected against liabilities such as education loans or family dependence. Buying term insurance early locks in low premiums for decades, making it far more cost-effective than starting later.

See here for buying guide on Term Insurance

Step 3: Understand SIP – The Backbone of Smart Investment

A Systematic Investment Plan (SIP) allows you to invest a fixed amount regularly in a mutual funds or stocks or any securities.

Have a look at Does the SIP investment concept suit you?

Simply put , SIP rewards consistency and discipline, does not predict market.

Step 4: Understand Investment products

- Equity Mutual Funds → ELSS for high returns with tax benefits, Index Funds , Midcap Funds

- Debt Mutual funds → Detailed article here.

- Hybrid Mutual funds

- Post office Schemes → PPF for long-term, tax-free savings, NSC for guaranteed returns.

Beginner guide on Investing in Mutual Funds – Learning Part I

Open a Demat account → Zerodha Link or you may open at any other broker.

The above all needs more reading and I don’t want to extend this article into much bigger. Those who are not aware of any of the above may read into a detailed article and Understand the basics and how it works.

Step 5: Understand the Payslip and Tax system.

Once your first salary is credited, the very first financial action you should take is to download your payslip and understand it line by line. Your payslip explains how your CTC converts into actual take-home pay. It is not simply divided by 12. There will be difference between CTC and Take-home pay due to statuary deductions like EPF, Professional Tax, Income Tax, etc.

Calculate Income Tax for your salary structure and decide on Old vs New Tax regime. (for Starting salary, New Tax regime would be better)

Step 6: Retirement Planning Starts with Your First Salary

It may sound boring and annoying. Yes Long term Investing is a boring. But think about a big number. Simply : 30 times your Annual Expenses.

Start 10% of your Income towards Retirement Goal

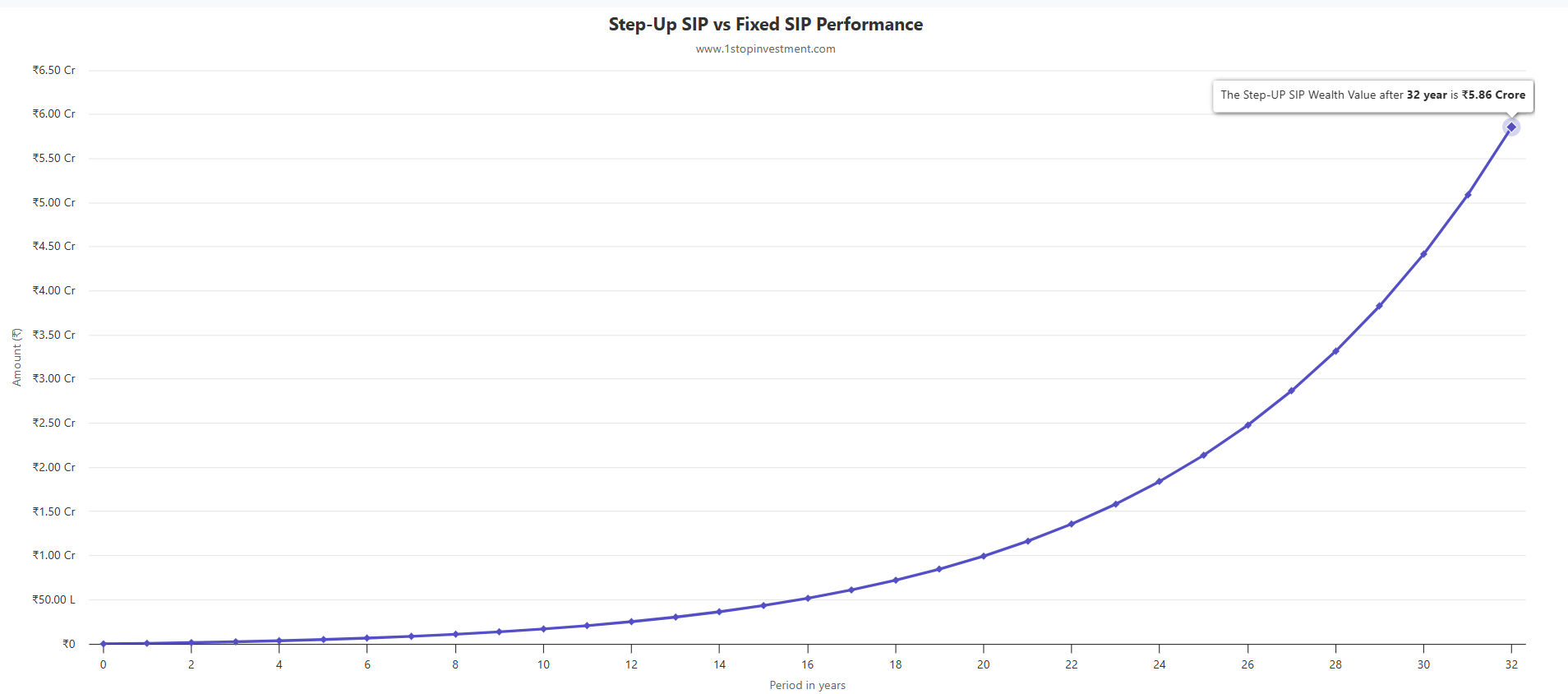

Say 5,000 (10% of your salary) and Step up 10% Every Year till you retire at 55 gives you 5.86Crores (12%return assumed)

The Above chart is generated from https://www.1stopinvestment.com/calculator/stepup-sip-calculator/.

Using NPS as one of the retirement goal product is also a better choice as it’s locked for this one goal and it can be made through employer as well.

Step 7: Other Goals

Define a clear financial goal plan for you with SMART financial goals: Specific, Measurable, Achievable, Relevant, and Time-bound.

To achieve each goal, you should set a defined period of time.

- Quick Goal –> Less than 1 year

- Short terms goals –> 1 to 5 years

- Medium term goals –> 5 to 10 years

- Long term goals –> more than 10 years

For Example,

Goal: Save ₹60,000 for a laptop in 10 months.

-

Specific: Laptop for fund

-

Measurable: ₹6,000/month

-

Achievable: Planned discretionary saving

-

Relevant: Prevents credit card debt

-

Time-bound: 10 months

Example: Use a recurring deposit or ultra-short-term fund.

What are some Financial goals for example ?

- Getting a new mobile phone , laptop comes under Quick Goal.

- Buying a Car or Bike , Planning a Vacation –> Short term goals

- Purchasing or building a house –> Medium term goals.

- Planning for your own Marriage –> Medium term goals .

- Retirement Planning –> Long term Goals

Other Pitfalls :

- Use credit cards only if you can pay the full amount on time and atleast , try to avoid for the first few years.

- Instant gratification today can mean financial struggle tomorrow. Money goes into liabilities and depreciating items like gadgets

- Falling for “get rich quick” Ponzi schemes.

- Trading in F&O without understanding

SEBI Study Reveals 93% of Individual Traders Incurred Losses in Equity F&O between FY22 and FY24

- Buying Insurance Endowment policies in the name of investment since your relative uncle or someone you know told so.

Ask them this Question “What is the CAGR of this policy and validate it ?” Don’t Mix Insurance and Investments products.

Final Summary:

- Savings create stability

- SIP creates growth through disciplined investing and Consistency beats intelligence.

- Investment is a necessity

- Understand that time in the market is more important than timing the market

Your personal finance journey is not about perfection—it is about starting and staying consistent. Rome wasn’t built in a day, Hence Start Planning Today !

Still if you are confused and need any assistance, you can reach out to me at mailto1stopinvestment@gmail.com with your queries and would be happy to answer.

Happy Investing.!!

Share your thoughts, questions, or personal finance goals in the comments and Share it with your friends if you find it interesting.

Few books I recommend you to read

-

The Richest Man in Babylon, Rich Dad Poor Dad , Psychology of Money, I Will Teach You To Be Rich

- I have complied a list of books. Check out here. My Bookshelf.