Are you looking for any below ?

What is NPS?

NPS stands for National Pension Scheme or New Pension Scheme. The Government of India launched this “Defined Contribution“retirement investment scheme. It offers pension in the old age for the people of India.

It gives investors an attractive long-term saving system to plan their retirement through the regulated market-based return.

Why to invest in NPS?

Retirement planning is a long-term goal and needs a disciplined investment approach. With most of the popular investment options, investors often withdraw the money after a few years of investment. This makes it difficult for them to achieve their investment objectives. However with NPS, the investments gets locked until the age of 60, by allowing you to remain invested for a longer period, National Pension Scheme helps you to achieve your retirement objective.

Who launched the NPS?

The Pension Fund Regulatory and Development Authority (PFRDA) has regulated this schem. National Pension System Trust (NPST), established by PFRDA, is the registered owner of all assets under NPS. The PRFDA appointed NSDL as Central Recordkeeping Agency (CRA) for NPS. CRA will give National Pension Scheme account holder with Permanent Retirement Account Number (PRAN).

Initially, only for new central government employees (except for armed forces) this scheme was mandated from January 2004. For all the Indian Citizens, it is available from May 2009 onwards. Now, NPS is mandatory for central and state government employees and an optional for Private employees and individuals.

Through the changes in the Income-tax Act 1961 through Union Budget Finance Bill, every change in the NPS is notified .

The main objective of the National Pension Scheme is as follows:

- Provide old age security and income to all Indian citizens

- Encourage people to save for retirement life when they reach 60 years of age

- Yield reasonable market-based returns over the long term

- Generate regular monthly pension

Who can join NPS?

Any Indian citizen who in the age group of 18-65 years can open an National Pension Scheme account either as an individual or through your employer. Even the investors’ employer can also co-contribute as well.

If the investor is joining NPS after 60 years, he/she can deposit upto the age of 70 and start receiving a pension like the one who joined before the age of 60 years.

Once the NPS account is opened, the account holder has to contribute every year till they reaches the age of 60 or met the exit conditions set by PFRDA.

Even NRI can open an NPS account. Contributions made by NRI are subject to regulatory requirements as prescribed by RBI and FEMA from time to time.

However, OCI (Overseas Citizens of India) and PIO (Person of Indian Origin) cardholders and HUFs are not eligible for the opening of an NPS account.

No Multiple accounts are allowed in NPS. Joint accounts are also not allowed.

The subscribers should comply with the Know Your Customer (KYC) norms as detailed in the subscriber registration form.

Once the Investors activate their NPS account, the investor receives a PRAN (Permanent Retirement Account Number) card which has a 12 digit unique number.

The minimum contribution at the time of account opening is Rs 500 for the Tier-1 account and Rs 1000 for the Tier-2 account.

What will be Maturity Time:

When the investor reaches the age of 60years, the National Pension Scheme scheme will become matured..

After 60, an Account holder can withdraw 60% (maximum) of their savings in NPS and the remaining 40% to be compulsorily used to purchase an annuity in the Pension fund which is taxable at the applicable tax slab.

The investor has options like,

- An investor can purchase annuity funds upto 100% of the accumulated wealth.

- He/She can delay the withdrawal and keep invested until the age of 70.

- Also, They can delay the mandatory purchase of pension funds for a maximum of 3 years.

The account holder has the flexibility in choosing the percentage of withdrawal and the remaining percentage shall be invested in the pension fund of their own choice of fund managers.

The NPS scheme has an option of choosing between Pension stops when the NPS account holder demise or it will be given to the spouse of the account holder after the death of the NPS account holder.

Type of NPS Account :

There are two types of NPS Accounts. They are :

1.Tier – 1 Account

2.Tier – 2 Account

- The tier-1 account is the non-withdrawable retirement account and compulsory account which is created when the investors join NPS and this has the Income tax benefits.

- The tier-2 account is the withdrawable account and optional account. The investors should have a Tier-1 account to open a Tier-2 account and this does not have any Income tax benefits.

How NPS works?

- Upon successful enrolment, a Permanent Retirement Account Number (PRAN) is allotted to the subscriber under NPS.

- Once the PRAN is generated, an email alert and an SMS alert is sent to the registered email ID and mobile number of the subscriber by NSDL-CRA (Central Record Keeping Agency).

- Subscriber contributes periodically and regularly towards NPS during the working life to create the corpus for retirement.

- On retirement or exit from the scheme, the Corpus is made available to the Subscriber with the mandate that some portion of the Corpus must be invested into Annuity to provide a monthly pension post-retirement or exit from the scheme.

Steps to Join NPS

1.By visiting POP-SP (Point of Presence – Service Provider)

Any citizen of India between the age of 18 to 65 can open an NPS account by visiting any POP-SP.

2.Through eNPS

A subscriber can open an NPS account online by visiting the eNPS website through PAN & Bank details.

How much can be Contributed?

- There is no maximum limit on the contributions

- However, the Minimum total contribution in a financial year is Rs.1000 for a tier-1 account.

- If the investor didn’t contribute the minimum amount in the financial year, the account will be frozen. To activate the account again, the account holder has to pay a penalty of Rs100 and the minimum contribution for that financial year by visiting the POP-SP

Income Tax benefits

Investment in NPS (Tier-1 account) is eligible for tax benefits as follows:

- Up to Rs. 150,000 under Section 80CCD(1). The benefit is additionally capped at 10% of the basic salary. The benefit under Section 80C, Section 80CCC and Section 80CCD(1) is capped at Rs 150,000.

- Additional tax benefit up to Rs 50,000 under Section 80CCD(1B). This is over and above tax benefit under Section 80CCD(1)

Investment in NPS (Tier-2 account) is not eligible for any tax benefits.

Available Pension Funds

The Pension fund managers will invest the subscribers’ contribution as per PFRDA guidelines. Subscribers have a flexible option to choose from the below pension funds:

- SBI Pension fund (Default Pension manager if the subscriber does not have any preference)

- LIC Pension fund

- ICICI Prudential Pension Fund,

- Kotak Mahindra Pension Fund,

- Reliance Capital Pension Fund,

- UTI Retirement Solutions Pension Fund,

- HDFC Pension Management Company, and

- DSP BlackRock Pension Fund Managers.

Annuity Service Providers

Annuity means a regular income for a defined period chosen by the subscriber at a defined rate.

The subscriber has to buy annuity atleast 40% of the corpus from the annuity service providers(ASP). ASPs are those who ensure the regular income after retirement for the NPS Subscriber.

Currently, these below insurance companies are recommended by PFRDA as ASPs:

- Life Insurance Corporation of India

- SBI Life Insurance

- ICICI Prudential Life Insurance

- Star Union Dai-ichi Life Insurance

- Reliance Life Insurance

- HDFC Standard Life Insurance

Annuity options

It is important to know different types of pension schemes offered by ASPs. They are as follows,

- Pension payable for life at a uniform rate to the subscribers only.

- Superannuation payable for life increasing at a simple rate of 3% per annum.

- Pension for life with return of purchase price on death of the pensioner.

- Annuity payable for 5, 10, 20 years certain and thereafter as long as he/she lives.

- Pension for life with a provision of 50 % of the annuity payable to spouse during his/her lifetime on the death of the subscriber.

- Annuity for life with a provision of 100 percent of the annuity payable to spouse during his/her lifetime on the death of the subscriber.

- Pension for life with a provision of 100 percent of the annuity payable to spouse during his/her lifetime on death of the subscriber and with the return of purchase price on death of the spouse.If the spouse predeceases the pensioner, payment of pension stops right away after the death of the pensioner and the nominee gets the purchase price.

Fund Management Choices

NPS gives 2 choices either Active Choice or Auto Choice.

1.Active Choice

- the option allows the investor to decide how they shall invest the money in different asset classes.

- Asset Class E (Equity and related instruments) – Maximum allowed 75% upto 50years of age and Above 51, Maximum permitted allocation is as per the equity allocation matrix shown below :

- Asset Class C (Corporate Debt bonds) – Maximum allowed 100%

- Class G Asset (Government/Gilt bonds )– Maximum allowed 100%

- Class A Asset (Alternative Investment funds like CMBS, MBS, REITS, AIFs, Invlts) – Maximum allowed 5% (Only for private sector subscriber)

- The total allocation across E, C, G and A asset classes must be equal to 100%.

2.Auto Choice

- It is the default option if the subscriber does not choose “Active Choice”. Automatically, the investor’s age decides the asset allocation.

- As per time left to retirement, his/her portfolio re-balances each year for the proportion of equity, corporate bonds, and government bonds

PFRDA has introduced new features to NPS in 2016, including more Auto choices to lifecycle funds :

- Aggressive Life Cycle Fund (LC-75) allows the subscribers with equity exposure of up to 75% till 35 years of age. This is more suitable for investor in the age of 20. Please see the below table for the asset allocation matrix of LC-75.

- Moderate Life Cycle Fund (LC-50) with a 50% starting equity exposure suits the investor in the age between 35 and 40. Please see the below table for the asset allocation matrix of LC-50.

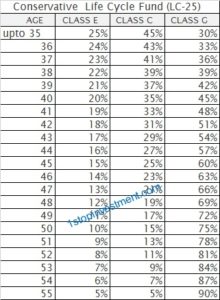

- Conservative Life Cycle Fund (LC-25) with a 25% starting equity exposure suits the old age investors. Please see the below table for the asset allocation matrix of LC-25.

- A Subscriber who wants to automatically reduce exposure to more risky investment options as he/she gets older, Auto Choice is the best option. As age increases, the individual’s exposure to Equity and Corporate Debt tends to decrease.

- Depending upon the risk appetite of Subscriber, there are three different options available within ‘Auto Choice’ – Aggressive, Moderate and Conservative

- Most importantly, NPS subscribers have the flexibility to change the investment choices only once in a financial year.

EXIT CONDITIONS

NPS allows Pre-mature withdrawal with 2 exit options.

Normal Exit : (Early Retirement Case)

“Normal Exit” is when the Investor doesn’t want to continue after 3 years from the date of joining.

Under Normal Exit, if the accumulated wealth is less than or equal to 2Lakhs rupees, an investor can withdraw the entire amount and no need to purchase any pension fund.

If the accumulated wealth is greater than 2Laksh rupees, they have to buy atleast 40% annuity which gives them a monthly pension and withdraws the remaining 60% as a lumpsum amount.

Pre-Mature Exit :

“Pre-mature Exit” is when the Investor leaves the scheme before 3 years from the date of joining.

Under Pre-mature Exit, if the accumulated wealth is less than or equal to 1 Lakhs rupees, an investor can withdraw the entire amount and no need to purchase any pension fund.

If the accumulated wealth is greater than 1 Lakhs rupee, they have to buy atleast 80% annuity which gives them a monthly pension and withdraws the remaining 20% as a lumpsum amount.

Death of subscriber :

In the event of the unfortunate death of the subscriber before the age of 60years, the entire accumulated wealth (100%) is paid to the nominee as Tax-Free. No need to buy any compulsory annuity.

PARTIAL WITHDRAWAL :

Tier-1 account allows the partial withdrawal.

NPS Tier-1 account with completed 3 years from the date of joining is eligible for the partial withdrawal.

The Maximum withdrawal amount is 25% of your contributions only.

The withdrawal frequency is only a 3 times during the entire tenure of NPS.

No Loan facility in NPS.

CALCULATION/ILLUSTRATIONS :

The above graph uses same data (5000 per month) except the age.

Conclusion :

Below are reasons why should Investors to start their investment in NPS:

- Backed by the Government of India

- Voluntary Scheme for the all the citizens of India

- Low cost product and low fund maintenance charges.

- Income Tax benefits for Individuals, Employees and Employers

- Attractive market linked returns

- Easily portable across locations and different jobs.

- Managed by experienced Pension Funds

- Regulated by PFRDA, a regulator set up through an act of Parliament

- Flexibility in choosing the withdrawal and fund managers

I hope that I have covered all the sections in the National Pension Scheme investment. So If you have any doubts or clarifications, you may feel free to contact me.

Please check out NPS Calculator available in our website.

Please read the other available investing options here.

Pingback: How can you spend this Lockdown that may change your financial life forever - 1stopinvestment.com

Nicely written