What is RD?

RD stands for Recurring Deposit or National Savings Recurring Deposit. The Government of India introduced this scheme in 1982 to create awareness among Indians about the habit of regular savings and disciplined regular investment every month. This scheme is one of the best choices for the investors who want to create a CAPITAL without any risk to the invested amount. The Capital invested monthly in this scheme is completely safe and guaranteed by the government. Now the SIPs in Mutual funds have taken over the RD recently by its lucrative returns but still, RD has its advantages.

Who can open Recurring deposits?

Only Indian resident is eligible for RD with a minimum investment of just 10Rs monthly.

Once the Deposited decides the Monthly deposit amount, the First monthly deposit shall be made while opening the account, That amount will be the denomination of that account. It cannot be changed during the maturity period of 5 years.

A resident can open any number of RD accounts.

A joint account can also be opened.

Parents or legal guardians can also open on behalf of a minor.

NRI’s & HUF’s are not eligible for this scheme.

If the depositor’s status changed to NRI during the currency of the account, the account shall be discontinued.

Where can it be opened?

The account can be opened at any post office or authorized bank.

While opening the account, a passbook will be given with investors and nominee details.

Nominee

The depositor has to indicate a nominee for the RD account. In an unfortunate event of death of the depositor, the nominee will receive the payments.

In the case of a Joint account, Joint holders are eligible to make changes in the nomination after the death of the one joint holder.

How long has to Invest in Recurring deposits:

The Investor has to remain invested in this account for 5 years.

A depositor has to make 60 monthly deposits in an account.

If the First deposit is made on or before the 15th of a month, a Subsequent monthly deposit shall be made up to the 15th of the month.

If the First deposit is made on or after the 16th of a month, a Subsequent monthly deposit shall be made after the 16th of the month but before the last working day of the month.

Default Account

A default fee is charged if the monthly deposit is not paid and a fee will be 5 paise every 5Rs. After 4 regular defaults, the account becomes inactive. Within 2months, the account has to reactivated by paying the defaulted monthly deposit with the default penalty fees.

Extension Period

The Investor is also eligible for an extension in a regular case for another block of 5 years.

The extension is allowed in case if there are not more than four defaults in the monthly deposits and the Extension shall be as many months as the number of defaults.

How Risk-Free it is :

It provides Capital protection and Fixed Returns to the investor like any other PO schemes. This is more suitable for the people who don’t want to take any risk in their Financial planning.

Interest Rate of Recurring deposits

The Current Interest rate is 7.2%. The Interest rate will remain the same throughout the tenure even if there is a change in interest thereafter. The Finance ministry reviews the interest rates on a quarterly basis.

The below graph shows the historic rates of Interest for this scheme

Compounding frequency

This scheme follows Quarterly Compounding method.

Income Tax Benefits:

One cannot have any Tax deduction under Section 80C of the Income Tax Act,1961.

The Interest received is Taxable.

No TDS is applicable to the interest earned. However, the depositor has to declare it while filing Income Tax under “Income from Other Sources”.

Investment payments / Deposits:

The payment mode shall be in cash if a deposit is below one lakh rupees.

More than one lakh rupees, It should be in the form of Cheque or Demand Draft(DD).

The minimum deposit is Rs.10 and No cap on maximum investment. However, the First deposit should be the denomination of the account.

Deposit Rebate :

This scheme offers a rebate if the depositor makes an advance payment of the monthly deposit in lumpsum. The advance deposit rebate in a calendar month shall be subdivided into two categories and as follows:

- Six or more deposits but not exceeding 11 deposits. – Rebate will be Rs.1 for Rs.10

- Twelve or more deposits – Rebate will be 4Rs for 12 deposits and One rupee for the balance deposits not less than 6 deposits.

Premature Closure

The RD scheme allows premature closure at any time due to the death of a depositor without any penalty charges.

Also, After 3 years it permits premature closure.

Partial Withdrawal

RD allows one withdrawal of up to 50% of the balance accumulated after one year. The depositor should repay it during the currency of the account in one lump sum or in equal monthly installments.

Transfer Options

The portability of the account from one deposit office to another is available.

Loan Facility

A loan facility is available.

Summary

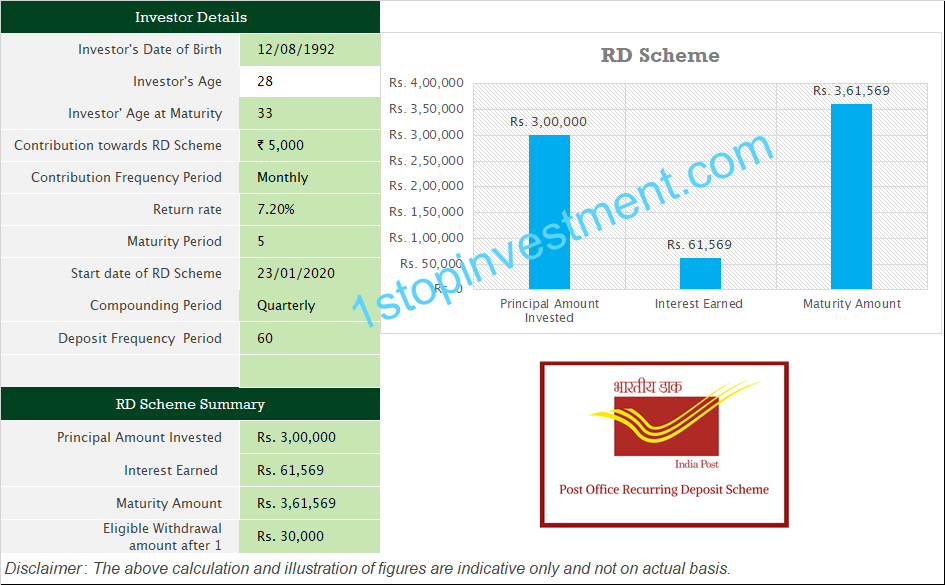

Example / Illustration

Conclusion

So for the peoples who want to create wealth for over small tenure, RD is the best option to accumulate the capital without any risk.

Finally, Anyone can open RD for goals like,

- Creating an emergency fund

- Create a Lumpsum fund for the Investment or buy land.

Using Recurring deposits, Buy some assets and never make a mistake of buying some liabilities like Bike, Car, TV.

Happy Reading Investors.. Click here to read more articles.