Equity Linked Savings Scheme (ELSS)

ELSS funds are the tax-saving close-ended mutual funds with a lock-in period of 3 years. The major portion of funds (minimum 80% or more) are invested in equity schemes. Equity schemes mean the fund invest in shares of companies of different market capitalization.

Under section 80C of Income Tax Act 1961, the investors can avail the tax benefit up to 1.5 lakhs per year..

Why to Invest in ELSS ?

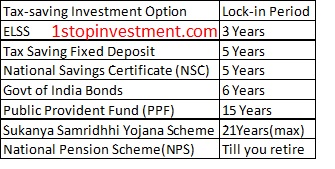

- It has TAX benefits over FD with the lowest lock-in period of 3 years.

- Returns are higher than the other tax-saving schemes.

- More suitable for Investors who want to gain return more than conventional FD returns with a higher risk than FD.

- Earlier the returns are tax-free and from the 2018 budget, the Gains from the investment are considered under long term gains. Currently, it is taxed at 10% for the gains over 1Lakh rupees.

How Lock-in period works ?

- During the 3 year Lock-in period, the investors cannot sell their investment from the date of their purchase.

- In case if the investors doing SIP (Systematic Investment Plan), Each installment has 3 years lock-in. It means funds bought in the 1st month will be released at the 37th month. Likewise, funds bought in the 10th month will be released at the 46th month.

- ELSS has a better lock-in period than other tax saving schemes.

How the ELSS helps investors to save Tax ?

Under section 80C of Income Tax Act 1961, the investors can avail the tax benefit up to 1.5 lakhs per year.

From the below table you can see how much the investors can save taxes*.

- (* Considered 4% cess into Tax calculations)

ELSS to be chosen for what Financial Goals ?

It is perfect for the short term goals for the following reasons,

- The lowest Lock-in period of 3 years

- Higher returns compared to other tax-saving schemes

- It provides savings in Taxes.

- Suitable for Goals like wedding, travel, home improvements, student loans.

How ELSS Fund Portfolio looks ?

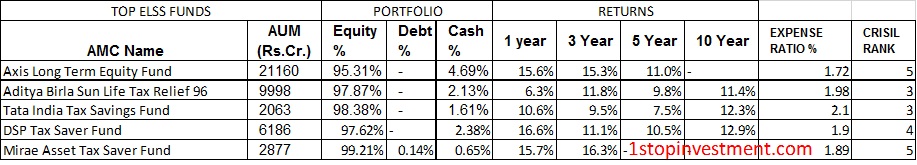

*The returns data is based on the NAV of a direct-growth variant of the schemes as on 11-DEC- 2019 Source: Moneycontrol & Valueresearch.

From the above table, you can see where the majority of funds invested and the returns are far better than Traditional Fixed deposits.

- ELSS Funds are diversified across different market capitalization such as Large Cap, Mid Cap and Small Cap. The average split up between these caps is 70-20-10 and makes this fund more stable by the price of Large Cap stocks like Reliance, HDFC Bank, TCS.

How to select ELSS Fund?

Before Investing, the investor has to select at which fund he wants to invest. He has to read all the market risks of the fund and take the decision accordingly.

Here are the few guidelines which to be considered while selecting the fund,

- Assets Under Management (AUM) Value

- Past Returns and Average Returns

- Expense Ratio

- Ratings

What does our Risk-meter Says :

Since the ELSS funds invest in equity stocks listed in NSE and BSE, they carry a higher risk of fluctuations. Being this higher risk factor doesn’t mean to scare you, but you should be aware of this factor before going invest in ELSS funds.

- But the short term volatility in the Equity is overcome by staying in the fund for the longer durations and makes ELSS capable to give better returns than other investment classes.

- There are no guaranteed returns in the Equity funds.

- Past performance may not repeat it’s glory.

How to reap Maximum Benefits :

- To overcome the Volatility in the Equity market, it is always preferable to do SIP in ELSS than a lumpsum investment.

- SIP or Systematic Investment Plan invests a Fixed amount in the ELSS fund every month or a defined period over the long years. Minimum Investment is Rs.500 per purchase.

- SIP gives the advantages of averaging cost basis per unit on the downside and compounding over the upside.

- Investor can opt for dividend option and get some cash flows during the lock-in period. However, to get more returns, the Investor should opt for Growth plans instead of Dividend plans. It varies on your goal.

- Let’s see an example if the investor invests Rs 3000 monthly and how much he gained.

How it works in the Real time investment :

Let me show an example in the real time. My wife started her investment journey back in September 2015 in the Axis Long term Equity Fund. You must see how much returns she has gained so far.

From the above Table and Graph, it is evident that Investing in ELSS is truly a better tax saving scheme available in India.

Units allocation & Cut-Off Timings for ELSS Funds

- If the order is placed before 1pm, units allotted will be based on NAV of the current day.

- If you placed after 1pm, units will be allotted based on the next day’s NAV.

- But, Zerodha COIN has set a blanket cut-off time at 11.30 am for placing mutual fund orders which is much earlier than the stipulated time by SEBI.

Please read the other available investing options here.

Please check out our SIP Calculator available here.

“Mutual Fund investments are subject to market risks, read all scheme related documents carefully.”