What is NSC?

Post office NSC or National Savings Certificate is the Government of India Savings Bond and comes under the category of Fixed Income Investment scheme. The Investor can purchase from any Post office. Also, it provides tax benefits to investors under 80C.

This scheme is for Investors with very low-risk appetite or those who want to diversify their portfolio through fixed returns schemes with a goal tenure of 5 years (NSC VIII).

The government started this scheme for the Fund generation for Building India after Independence. Later it transforms into a Tax saving investment scheme.

Who can open National Savings Certificate?

This Scheme backed by the Government of India is only available for the Indian Residents at the Post office.

NRIs Cannot purchase NSC certificates. But In case the Indian Residents become NRI during the holding period of the certificate, those NSCs can be kept till maturity.

Even HUFs and trusts cannot invest in this scheme.

Joint accounts are allowed in this scheme

NSC has different modes of holding by the Investors.

How to Buy it ?

You can buy the National Savings Certificate via Post office or Public sector banks or few Private sector banks (HDFC Bank, Axis Bank & ICICI Bank).

The holding mode shall be either in Electronic mode or in Passbook mode.

For those who want to buy in Online, Internet banking facility should be available in the Saving account with Post office or Bank.

Which documents are required ?

- NSC Application form

- ID Proof like PAN Card or Passport or Voter ID.

- Passport size Photograph

- Current Address proof such as Electricity bill or Telephone bill.

How long has to Invest :

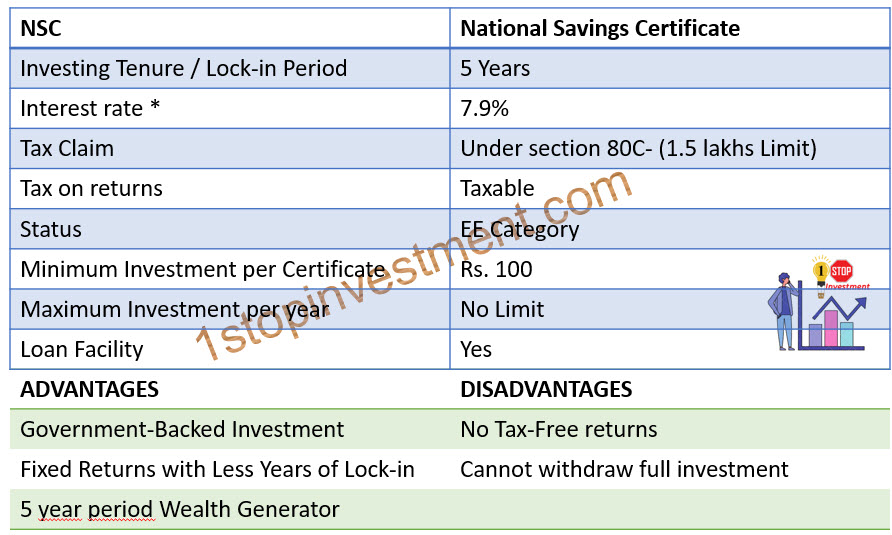

NSC has a Fixed maturity period of 5 years from the date of allotment.

How Risk-Free it is :

Since Government of India sponsor this scheme, It provides Capital protection and regular income to the investor.

This is more suitable for the people who don’t want to take any risk in their Financial planning.

Interest Rate

The Current Interest rate is 6.8% (compounded annually).

The Central Government Finance Ministry revises the NSC interest rates every quarter. The below graph shows the historic rates of Interest for this scheme.

For the Current Interest rate , Check this page Post Office Small Saving Schemes interest Rates

Tax Benefits:

Under section 80C of Income Tax Act 1961, the investors can avail the tax benefit up to 1.5 lakhs per year.

However, the maturity interest earned is Taxable.

No TDS ( Tax Deducted at Source) applies to the interest earned for this scheme.

Investment in NSC:

These certificates come with a denomination of ₹100 to ₹10,000.

The minimum amount is ₹100.

There is no limit to the maximum amount that can be deposited in an NSC

Pre-mature withdrawal

The NSC Scheme does not allow pre-mature withdrawal before the maturity date. For instance, NSC allows it if the certificate holder demise.

Transfer Options

The portability of the account from one deposit office to another is available.

It has the option to transfer the ownership from one person to another.

Loan Facility

Loan Facility is available against NSC.

Summary

Example / Illustration

Conclusion

Concluding the post that, NSC is a must-have investment for the retail investors with Low-risk appetite. Also, For investors whose investment horizon is 5 years and wants a fixed return for that goal, NSC would be the better choice with tax-saving benefits.

Please check out NSC Calculator available in our website.

Happy Reading Investors.. Click here to read more articles.