What is KVP?

Kisan Vikas Patra, a Government guaranteed small savings with market risk-free investment. It is launched by the Post office in the year of 1988 which gives the amount invested in this scheme will be doubled after the pre-determined maturity period. The Rule of 72 is applied here to find the maturity period. The maturity period varies with the Fixed return rate while purchasing the certificate.

The Maturity value is pre-printed on the certificate issued with the maturity date.This scheme is mostly suited for investors who want assured returns and don’t want to take any market risks.

“Kisan” means Farmers. This scheme is focused to provide farmers some guaranteed returns of their hard-earned money. The funds collected from this scheme are used for the Farmer welfare schemes. But it doesn’t mean that only farmers can invest in this scheme. We will see who all can invest in this scheme.

Who can open Kisan Vikas Patra

- Adult Resident citizens of India can open the KVP scheme in the post office or some selected banks by submitting KYC documents.

- Even it can be opened on behalf of a minor with a nominee registered.

- NRI’s & HUF’s are not eligible for this scheme.

- Trusts can purchase.

- Joint Accounts are allowed.

The certificates shall be of the following types, namely:-

(a) A Single Holder Type Certificate may be issued to an adult for himself or on behalf of a minor or to a minor;

(b) A joint ‘A’ Type certificate may be issued jointly to two adults payable to both the holders jointly or to the survivor.

(c) A joint ‘B’ Type certificate may be issued jointly to two adults payable to either of the holders jointly or to the survivor.

How long has to Invest in this Scheme:

The KVP maturity period is 124 months with a current Interest rate of 6.9% (i.e) 10 Years and 4 months.

How Risk-Free it is:

Being backed and promoted by the Government of India, it is safe, guaranteed doubled returns regardless of the market fluctuations and risk-free savings instrument.

This scheme is not subjected to market risks.

Interest Rate

The current interest rate is 6.9% and the principal is compounding annually. It is decided by the central ministry of finance. It’s revised every quarter. Please see below the graph of how it’s changed over the years.

*Interest rates mentioned in this graph here as on date 1-Jan-2020.

Between the period of 1 Dec 2011 to 17Nov 2014, this scheme is discontinued due to the money laundering issue. Later it’s launched with new rules while depositing

to control money laundering. The depositor has to show a PAN card if he/she deposits more than 50,000 in a financial year.

Tax Benefits:

There are no tax benefits for this scheme. Returns are taxable as per the investor’s applicable income tax slab.

TDS is exempt from withdrawals after the maturity period.

Nominee

The depositor has to indicate a nominee for the KVP account. In an unfortunate event of death of the depositor, the nominee will receive the payments.

Investment in Kisan Vikas Patra:

These certificates come with a denomination of ₹100 to ₹50,000.

The minimum amount is ₹1000.

There is no limit to the maximum amount that can be deposited in a KVP.

Pre-mature withdrawal

Certificate can be encashed after 30 months from the date of the issue. Please see below the encashment table.

Table showing premature encashment value of Certificate- Denomination of Rs.1000/- (Amount in Rs.)

| After | Amount payable |

|---|---|

| 2 and half years but less than 3 years | 1201 |

| 3 years but less than 3 and half years | 1246 |

| 3 and half years but less than 4 years | 1293 |

| 4 years but less than 4 and half years | 1341 |

| 4 and half years but less than 5 years | 1391 |

| 5 years but less than 5 and half years | 1443 |

| 5 and half years but less than 6 years | 1497 |

| 6 years but less than 6 and half years | 1553 |

| 6 and half years but less than 7 years | 1611 |

| 7 years but less than 7 and half years | 1671 |

| 7 and half years but less than 8 years | 1733 |

| 8 years but before the maturity of the Certificate | 1798 |

| On maturity of Certificate | 2000 |

| Source : nsiindia.gov.in |

Transfer Option

The portability of the account from one deposit office to another is available.

Loan Facility

KVP Certificates can be used as Collateral for getting loans.

Summary

* Current Interest rate – 6.9% and Investing tenure is 10 years 4Months.

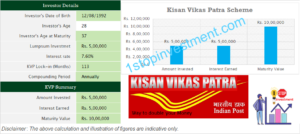

Example /Illustration :

Conclusion

- KVP, Sovereign guarantee scheme with better interest rates than Fixed Deposits in banks.

- There is no chance of risking the capital. It has Capital protection.

- Pre-mature withdrawal is available.

- Long term wealth generation

- No Maximum limit on KVP

So, If investors are looking for fixed returns by investing Lumpsum amount with Capital Protection, then this scheme is the scheme that is suited for them. For Risk-taking investors, there are so many other options and you can read about other investment schemes here.

Thanks for reading Investors.. Click here to read more articles.