What is SSA or SSY?

Sukanya Samriddhi Account or Sukanya Samriddhi Yojana is a saving scheme backed by the Government of India and launched by Prime minister Narendra Modi in 2015 under the campaign of “Beti Bachao, Beti Padhao” which means “Save the daughter and Educate the daughter”. The main aim of this scheme is to provide a prosperous future for the girl child. This scheme was well-received by the Indian parents. They started generating funds and giving financial security to achieve their education and marriage expenses for their female child.

Who can open?

- Either Parents or legal guardians can open SSA account in the name of their girl child at any post office or authorized banks, Such account should be opened before the age of 10 years.

- Only one account can be opened in the name of a girl child.

- If a family has 2 girl children, then they can open a maximum of 2 accounts in the name of their children. A maximum of 2 accounts per family is allowed. They cannot open further if they have more than two girls.

- But in the event of twin girls or triplets as second birth, it is allowed to open a third account for the family by producing a certificate from the competent medical authorities.

- Birth Certificate of the girl child is mandatory to open the SSA account along with identity and residence proof of the parents or legal guardian.

- While opening the account, a pass-book will be given with account holder details and it should be presented at the time of deposit and Final closure on maturity or partial withdrawal.

- Duplicate passbook facility can be availed in case of loss or damage of the original passbook at a cost of Rs.50.

- NRI’s are not eligible to open the SSA account. Also, in case of a change in citizenship status to NRI, it has to be notified and SSA account to be pre-maturely closed, the Balance available will be paid to the investor.

How long has to Invest :

The account can be closed after the completion of 21 Years from the date of opening of the account or the marriage of the account holder whichever is earlier.

No interest will be paid beyond the maturity period of 21 years

How Risk-Free it is :

Being a government-backed system, It’s a risk-free investment and Long term wealth generation to meet the expense for the Higher education or Marriage.

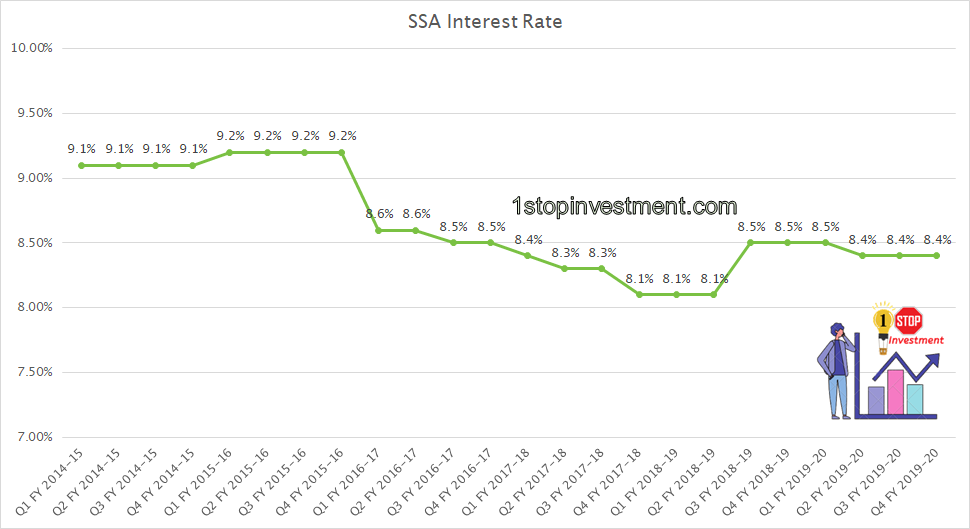

Interest Rate

The current Interest rate is 8.4% which is compounding annually. It is decided by the central ministry of finance. It’s revised every quarter.

The below graph shows the historic rates of Interest for this scheme

From the above graph, it is visible that the Interest rates are much higher than the PPF account and other government schemes.

Income Tax Benefits:

While investing, it offers many tax benefits to the parents such as,

During the investment time – the invested amount is tax-exempted under section 80C – maximum 1.50Lakhs,

Also, there is tax-exempted for the interest earned during the lock-in period which is reinvested (compounding annually and credited to the account at the end of the financial year) and

At the time of tenure closure, the maturity amount received is also tax-exempted.

This makes SSA investment under EEE Category.

Investment in SSA:

- The initial deposit in SSA while opening the account is Rs.250.

- The minimum deposit per financial year is Rs.250.

- The maximum deposit is Rs.1,50,000 in a financial year.

- Deposit to be made till the completion of 14 years from the date of opening of the account. After that, the account earns an interest in the amount accumulated.

- If the minimum deposit is not made in the financial year, the account comes under the default account. A penalty charge of Rs.50 per year for such a default account is levied. The minimum deposit for that year to be paid to make the account active again.

Pre-mature withdrawal

A Girl child can withdraw 50% of the available balance at the credit column at the end of the preceding financial year. But the minimum age should be 18 years to avail of such options. Often, this scheme helps for her Higher education expenses.

Transfer Options

The account can be transferred from one locality to another place in India.

But it is not allowed to transfer an account from one child to another child.

Pre-mature closure

In the unfortunate event of the death of the account holder, the parents or legal guardian can approach for closure of the SSA account by producing the death certificate issued by the competent authority. The balance available at the credit section preceding the month of death of the account holder will be paid to the guardian of the account holder.

If the guardian is unable to continue the account and causing undue hardship, proper permission from the competent authority shall proceed for pre-mature closure.

Also, premature closure is allowed under extreme cases such as medical support in life-threatening diseases or terminal illnesses.

Loan Facility

SSY scheme does not have Loan facility option.

Summary

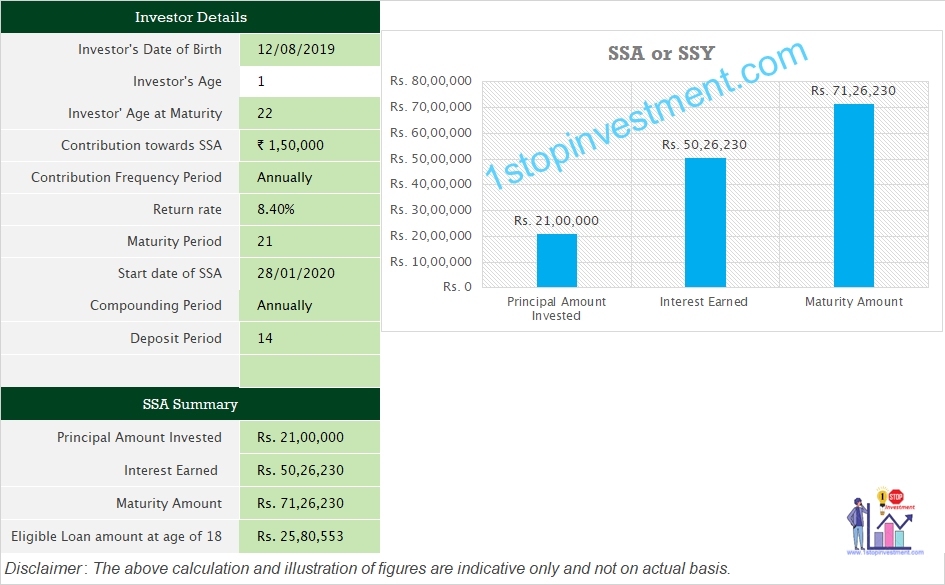

Example / Illustration

When a newborn girl opened the SSA account and Maximum benefit will be reached in this scheme.

The below graph shows the loan amount eligible with the start of SSY account when the Child aged 18 .

Conclusion

So to Conclude, Since it is Sovereign guarantee government Investment scheme and for specific goals like Marriage and Higher education. With the Disciplined investment, the account holder’s future is secured and it offers EEE Tax benefits. Risk-averse investors can invest in this scheme without any worries.

Please check out SSY Calculator available in our website.

Please read the other available investing options here.

Pingback: Sukanya Samriddhi Scheme: New Changes that you should know

Pingback: How can you spend this Lockdown that may change your financial life forever - 1stopinvestment.com