Recently, Reserve Bank of India (RBI) on Friday announced No Change in reverse repo rate at 3.35 percent from 04 June 2021.

Earlier, It announced a 40 bps(Basis points*) cut in reverse repo rate to 3.35 percent from 3.75 percent earlier on 22 May 2020.

*(100 basis points = 1 percent).

What is Reverse Repo Rate (RRR)?

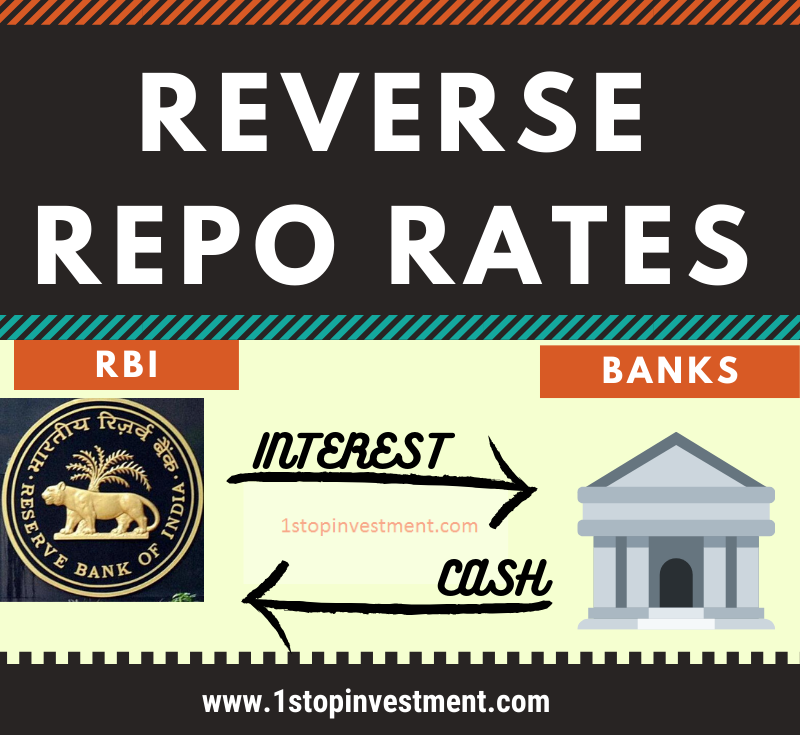

Reverse Repo (Repurchase Options) rate is the rate at which the Central bank of a country borrows money from commercial banks. In India, Reserve Bank of India borrows money at an Interest rate from the banks for the short term.

Also, this helps bank to park their surplus idle money or the excess funds with RBI for a short term and earns interest on it.

The opposite of Reverse Repo Rate is the Repo Rate. (Read in detail here)

Always RRR is lesser than the Repo Rate. Because the difference between the two is the RBI’s income.

Also, It forces banks to lend money to the individual or business rather than keeping money with RBI.

In India, the current Repo rates and RRR is decided by the RBI’s Monetary Policy Committee headed by the RBI Governor.

How it helps economy?

RBI uses Reverse REPO rate as an instrument to control the Liquidity in the banking system.

Increase in RRR helps bank to gain more interest for the surplus funds parked in Reserve Bank of India.

The above transaction happens under Liquidity Adjustment Facility (LAF).

The current RRR in India is 3.35%, effective from 04 June 20.

India’s Reverse Repo Rate History Trend Chart:

Source : RBI

How Reverse Repo rate (RRR) change Impact on economy:

Whenever there is a change in RRR, The lending rates and deposit rates will also get impacted.

Impact on Home Loans:

If the RRR are hiked / increased by any basis points, banks will increase their lending rates. Because, if bank provides loan it may have NPA risk and if it’s given to RBI it will be more profitable for the Banks.

Home loans get cheaper if the reverse repo rates are cut. Instead of parking money at lower interest rate, Banks lend to Individuals or Customers at a higher interest rate than RRR.

Impact on Fixed Deposits:

If the Reverse repo rates are cut / decreased by any basis points, banks will decrease their deposit rates. As a result, Interest from FDs are likely to reduce which have impact on those who depend on it. The Senior Citizens FD plans also get impacted. The savings account interest also gets reduced.

Impact on Rupee & Inflation:

Higher RRR boosts the strength of the rupee as it reduces the money supply in the market which controls the inflation in the economy. When RBI cuts RRR, it will increase the money supply in the market.

Happy Learning.