Are you looking for any below ?

What is ELSS Tax Saving?

ELSS (Equity Linked Savings Scheme) is a type of tax-saving mutual fund that helps investors reduce their income tax while creating long-term wealth. ELSS funds invest predominantly in equities and equity-related instruments, offering the potential for higher returns compared to traditional tax-saving options.

Under Section 80C of the Income Tax Act, ELSS investments qualify for tax deductions up to ₹1.5 lakh per financial year, making ELSS one of the most popular choices for ELSS tax saving funds in India.

Why ELSS is the Best Tax Saving Option Under Section 80C

ELSS stands out among tax-saving instruments due to its unique combination of tax benefits, growth potential, and flexibility.

Key Benefits of ELSS Tax Saving

-

Tax deduction up to ₹1.5 lakh under Section 80C

-

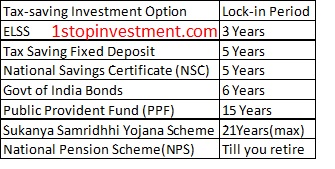

Shortest lock-in period of 3 years among tax-saving options

-

Market-linked returns with long-term wealth creation potential

-

SIP and lump sum investment options

-

Professionally managed by experienced fund managers

How ELSS Tax Saving Works

When you invest in an ELSS mutual fund:

-

Your investment qualifies for a tax deduction under Section 80C only in Old Tax Regime.

-

The amount is invested in equity markets to generate long-term returns.

-

A mandatory lock-in period of 3 years applies to each investment.

-

After the lock-in, you can redeem your investment fully or partially.

Important: ELSS gains are subject to Long-Term Capital Gains (LTCG) tax at 10% on gains exceeding ₹1 lakh in a financial year.

How Lock-in period works ?

- During the 3 year Lock-in period, the investors cannot sell their investment from the date of their purchase.

- In case if the investors doing SIP (Systematic Investment Plan), Each installment has 3 years lock-in. It means funds bought in the 1st month will be released at the 37th month. Likewise, funds bought in the 10th month will be released at the 46th month.

- ELSS has a better lock-in period than other tax saving schemes (see below).

Quick Comparison of ELSS Tax Saving fund vs Other Section 80C investment Options :

Who Should Invest in ELSS?

ELSS tax saving funds are suitable for:

- Investors with a minimum 5–7 year horizon

- Those comfortable with moderate to high market risk

- who understand the Market volatility which can impact short-term returns

- Lock-in restricts liquidity for 3 years

-

Returns are not guaranteed

ELSS is best suited for long-term investors who can stay invested through market cycles.

Guide to Select ELSS Funds for Tax Saving – for 2026

While selecting ELSS funds, every investor has to understand all the market risks of the fund and take the decision accordingly. Below Guidelines may help to take decisions better:

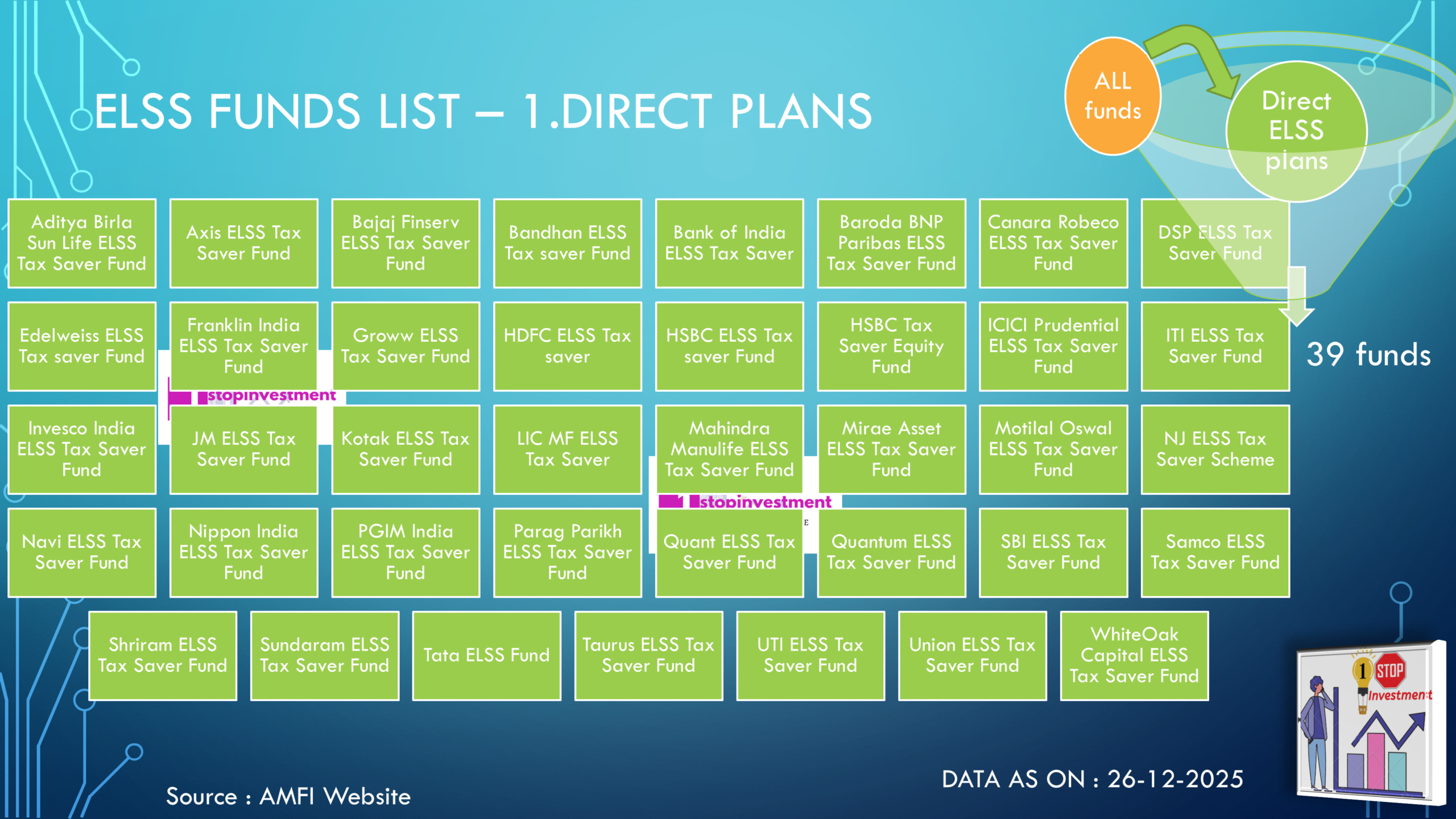

- Know the list of available funds from AMFI website (39 direct funds available as on 26-Dec-2026)

- Survival Period (more than 10 years) – As per you risk profile, you shall increase the period or decrease the period as you want to filter the funds.

-

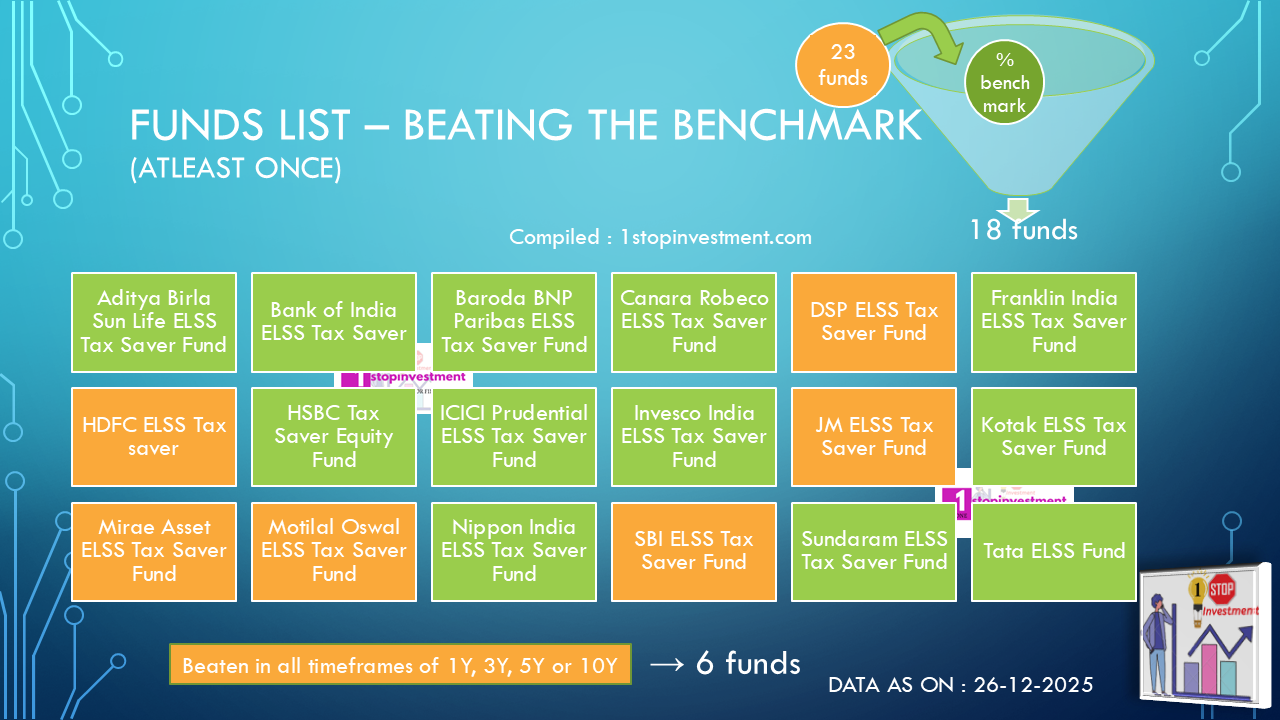

Consistent on 1-year, 3-year, 5-year and 10-year performance with Less Tracking Error

- Funds Beating all the Time Frames

-

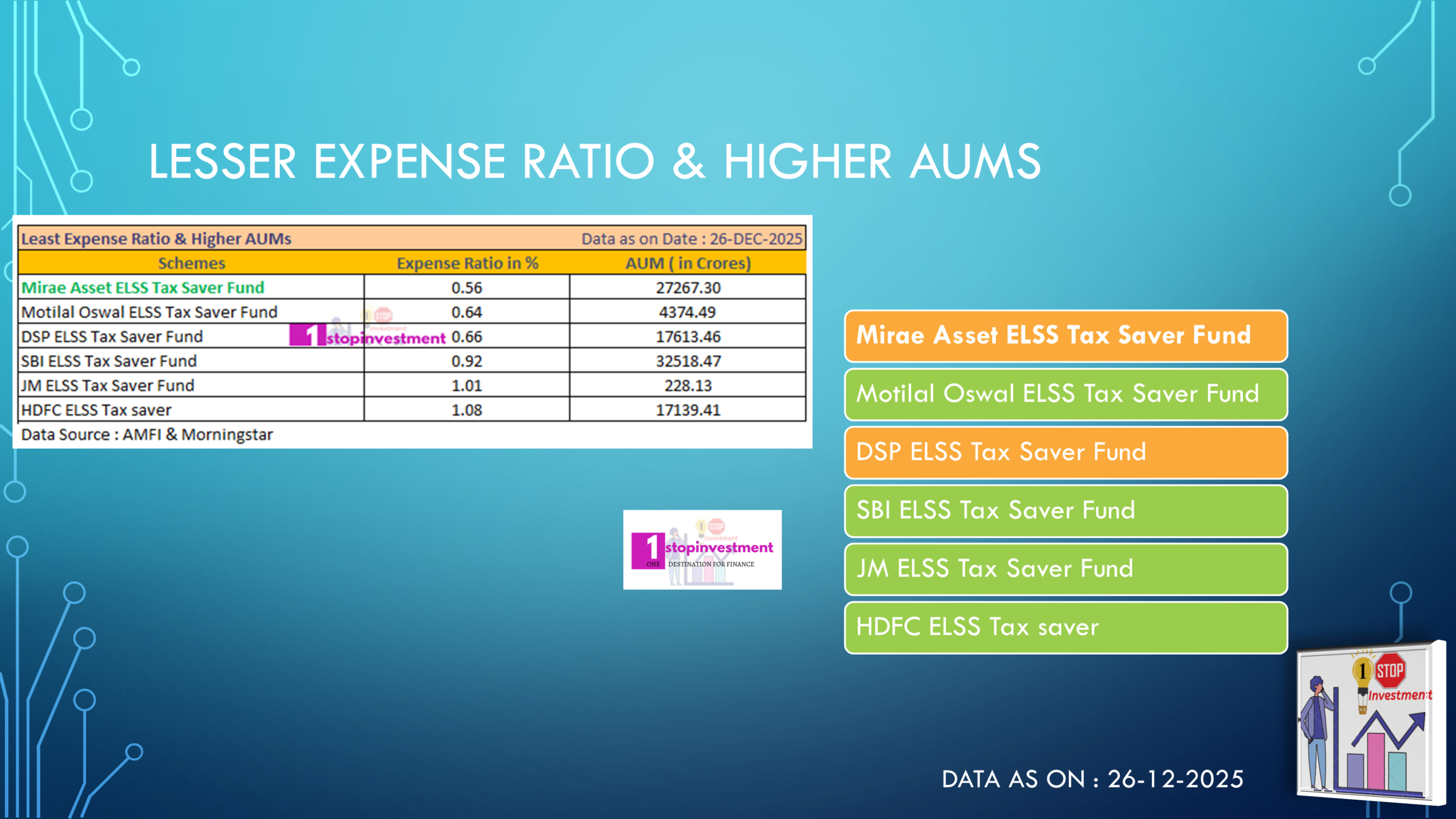

Higher Assets Under Management (AUM) Value & Lesser Expense ratio

Best ELSS Funds to Invest in this year 2026

Considering the analysis of AUM value, Expense ratio and Past Performance in all the Time Frames, Below will be my choice of Investment.

- DSP Tax Saver Fund

- Mirae Asset Tax Saver Fund

- Motilal Oswal ELSS Tax Saver Fund

As, we have set 10 year Period. In the Less than 10 Year period from the Launch date, One can also check Parag Parikh Tax Saver Fund (which is performing well).

Previous Year Analysis :

- Top 5 tax saving ELSS mutual funds to invest in FY 2022-2023

- Top 5 tax saving ELSS mutual funds to invest in FY 2021-2022

Other Tools for your analysis:

Excel Templates : → Templates – 1stopinvestment.com

Premium Tools in Store : → https://instamojo1stopinvestment.myinstamojo.com/

Web Calculators : → Financial Calculators-1stopinvestment

Conclusion: Why ELSS is Ideal for Tax Saving

ELSS tax saving funds combine tax efficiency, growth potential, and flexibility, making them one of the best Section 80C investment options in India. With a short lock-in and equity exposure, ELSS is well-suited for long-term financial goals.

Start early, invest regularly, and use ELSS not just to save tax—but to build wealth.

“Mutual Fund investments are subject to market risks, read all scheme related documents carefully.” & read Disclaimer – 1stopinvestment.com before investing.

You can write to us with your query at mailto1stopinvestment@gmail.com.