Dear Reader,

We are now on Telegram! Get our latest views on stock markets and more, instantly. Join our Telegram channel here!

Check out the latest addition in our Website Calculator Page – Implied Volatility Range Calculator.

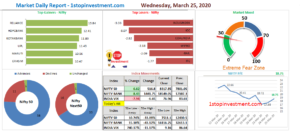

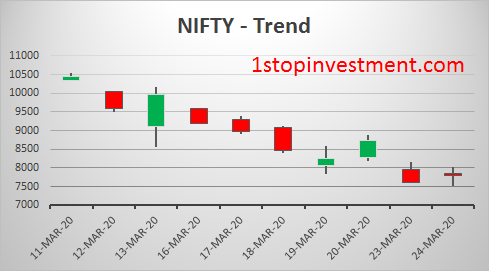

Yesterday’s Mayhem cools today and market closed in Green today.

Sensex was up 692.79 points(2.67% up) closed at 26674.03, while Nifty was up 190.80 points(2.51% up) closed at 7801.05. About 927 shares have advanced, 1310 shares declined, and 145 shares are unchanged.

Nifty Hits new 52week low during the day and bounced back with relief measures from FM.

Indusind Bank tanks 25% during the day and closed at 6.79% down at 313.6.

Please See our Dashboard report below.

Nifty PE = 17.58

| NIFTY 50 | Open | High | Low | Close |

| 24-Mar-20 | 7848.3 | 8036.95 | 7511.1 | 7801.05 |

| NIFTY BANK | Open | High | Low | Close |

| 24-Mar-20 | 17705.85 | 17841.4 | 16116.25 | 17107.3 |

| INDIA VIX | Open | High | Low | Close |

| 24-Mar-20 | 71.99 | 86.64 | 71.99 | 81.94 |

| BAJFINANCE | SBIN | BPCL |

| MARUTI | BAJAJ-AUTO | LT |

| ICICIBANK | HDFCBANK | HDFC |

| TATAMOTORS | HEROMOTOCO | AXISBANK |

| TITAN | BAJAJFINSV | INDUSINDBK |

| GRASIM | M&M |

DAY HIGHLIGHTS :

- Infosys gets clean chit from SEC in whistleblower case

- PM to address the Nation at 8pm

- Tokyo Olympics to be rescheduled to next year Says IOC

Compliance related measures / reliefs announced by FM :

- Income Tax

ITR date for AY 2019-20 extended to 30 June 2020 from 31 March 2020. (Time barring)

Interest rate reduced from 12% to 9% for AY 2019-20, for returns due of 30 June 2020.

TDS interest rate reduced to 9% from 18%.

Date of all order / returns / appeal / notice / application/ reports/ investment in saving scheme and benefits extended to 30 June 2020 from 31 March 2020.

Aadhar PAN linking date extended to 30 June 2020.

Vivad se vishwas scheme extended to 30 June 2020. No additional charge.

- GST

Last date for filing March April and May extended to 30 June 2020. (Staggering dates).

Entities having turnover below Rs. 5crores no interest, no penalty, no late fees.

Entities having turnover above Rs. 5 crore no penalty and late fees, but interest to be charged @9%.

Date for opting composition scheme extend to 30 June 2020.

- Custom/Excise

Sabka Vishwas date extended to 30 June 2020. No interest levied if payment upto 30 June 2020.

Customs clearance to operate 24**7 upto 30 June 2020.

- MCA

MCA21 Registery moratorium issued from 1 April 2020 to 30 June 2020. No late fees shall be applicable.

Period for holding board meeting, relaxed by period of 60 days, for next 2 quarters.

Applicability of CARO 2020 will be made applicable from the year 2020-21 instead of 2019-20.

For the year 2019-20, if the independent directors is not able to attend even a single meeting, the same shall not be considered as violation.

New company incorporated get additional 6 months to file commencement of business certificate.

Mandatory reserve 20%/15% in case of maturity of deposits and debenture extend to 30 June 2020 from 30 April 2020.

- IBC

Threshold limit of default increased from 1 lakh to 1 crore.

If the situation continues till 30 April 202, then Suspension of section 7,9 and 10 (insolvency proceedings) for 6 months.

- BanksDebit card holder can withdraw cash from any other banks ATM without any additional charges.

No minimum balance fees in bank accounts.

Digital trade bank charges completely waived.

Please follow us for daily reports.