Before diving to Mutual Fund Portfolio Overlap, Small intro to Mutual fund ,for newbies:

A mutual fund is a pool of Investor’s money managed by a professional Fund Manager.

Simply put, the money pooled in by a large number of investors together to earn good returns on their capital is what makes up a Mutual Fund.

More detailed article here – Part- I → Beginner guide on Investing in Mutual Fund

What do you mean Mutual Fund Portfolio Overlap?

When you are invested in multiple funds for diversification, but if the funds are invested in the same assets. Then the common assets or shares is called Portfolio overlap.

If there is huge overlap between funds you invested, then the Individual risk profile increases enormously.

For Example,

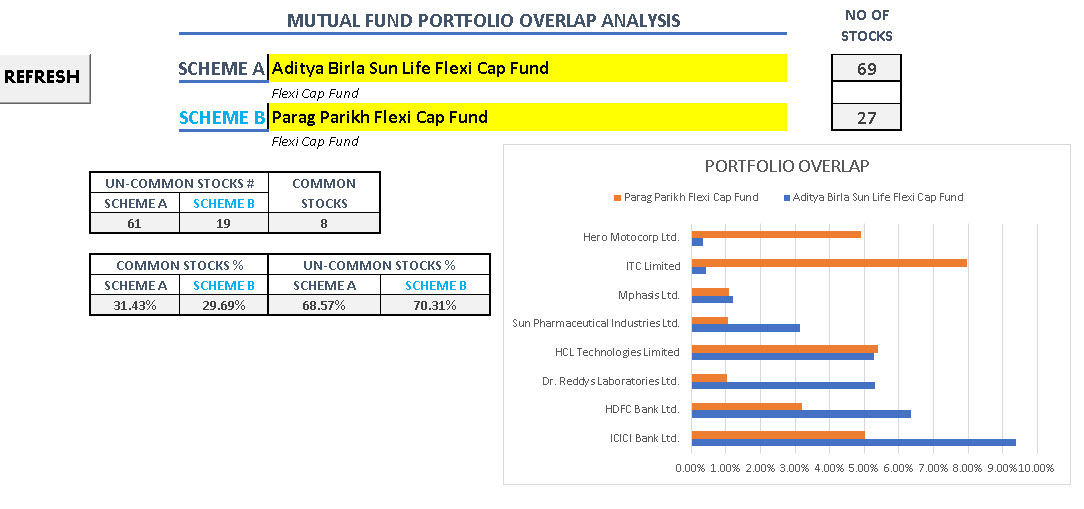

Let’s say, you are invested into 2 different Equity funds A & B. Portfolio of A has 69 Stocks and B has 27 Stocks. Both fund has common stocks 8 nos. % of holding of those 8 stocks is 30% approx. Those common stocks in the funds is your Portfolio overlap.

How shall we evade Mutual Fund Portfolio Overlap?

Firstly, you need to know what are the assets your funds are invested into.

There are few online websites available where overlap analysis is done.

You can also purchase the below Excel tool and do DIY Mutual fund portfolio overlap analysis.

To avoid Convenience fee in payment Gateway, Use UPI payment also. (For Indian payments only)

Pay Rs.399 via UPI Payment to 1stopinvestment@icici

Send the same Screenshot to the email id : mailto1stopinvestment@gmail.com with Subject “Mutual Fund Portfolio Analyser”

This tool helps in fetching the fund portfolio and Extend your research for deep analysis.

How much overlap is bad for you?

If the portfolio overlap is greater than 60-70%, then portfolio diversification is less. You have to revisit the funds and consolidate the funds into one or choose different funds where the overlap is less.

Conclusion :

As we speak diversification in the investing , It is better to do Overlap analysis in mutual funds. It helps in minimizing the losses if happens.

Happy Investing.

Read the most popular article here :

Check out other tools here Excel Spreadsheet Templates.