What is Credit Rating?

Credit rating is the outcome from an analysis of the Credit risks associated with the financial instruments or a financial body.

The rating will be given based on SEBI guidelines. Main criteria considered will be the Credibility of the company, Strength of the Entity’s financial statements in terms of borrowing and lending in the past period.

Hence the ratings will be given by CRA (Credit Rating Agencies) after analyzing the entity business and its finance risks associated with it.

A credit rating indicates the issuer’s ability and willingness to pay interest and principal on time.

The credit rating implies the ability of the entity to repay its debt.

Who are CRA?

Credit Rating Agencies investigate a borrower’s capacity to pay back the debt and also rate their credit risk. All the credit rating agencies in India are regulated by SEBI (Credit Rating Agencies) Regulations, 1999 of the Securities and Exchange Board of India Act, 1992.

There are a 6 credit agencies in India such as,

- CRISIL (Credit Rating Information Services of India Limited)

- CARE (Credit Analysis and Research limited)

- ICRA (Information and Credit Rating Agency)

- SMREA (Small and Medium Enterprises Rating Agency)

- Brickwork Rating (BWR)

- India Rating and Research Pvt. Ltd.

How the CRAs works?

The above agencies assign ratings to an entity. The entity may be Listed/Unlisted companies, State governments , Non-Profit organisations and other local / international bodies. CRAs give their respective rating to the entities after analyzing the organization’s financial health.

How it helps the investors?

Credit rating always gives investors an edge over their investment decision.

Low/Poor credit rating indicates that the Company is at a high risk of defaulting and Investor shall look for the fund portfolio and avoid taking such risks in their investment.

Credit rating serves as the benchmark for the investors to analyse the funds and its holdings.

Upgrading and Downgrading the company’s credit rating suggests its ability to repay the debt. If a company is downgraded, then it becomes difficult for the company to borrow also. Financial institutions will be reluctant to lend money to low credit rated companies as they have higher chances to become defaulter.

These ratings should not be considered as an Investment advice rather it should an tool or criteria to look for before doing any investment decision.

What are the Credit Rating Scales given by CRAs ?

Credit rating is always denoted by the Alphanumeric symbol.

Please find below table for the Ratings and it’s risk associated.

| Rating Scale | Credit Risk |

|---|---|

| SOV | Sovereign Guarantee - No risk of default |

| AAA | Highest safety & Lowest risk |

| AA | High safety & Very low credit risk |

| A | Low credit risk |

| BBB | Moderate credit risk |

| BB | Moderate risk of default |

| B | high risk of default |

| C | Very high risk of default |

| D | Default or On the verge of default |

But. the above ratings are the relative measures of default probability, not a guarantee against default.

How to check for ratings in a debt fund portfolio?

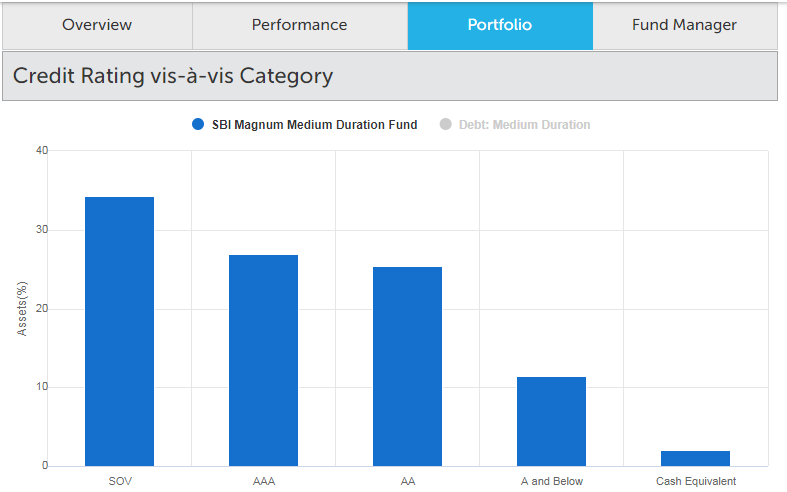

Let’s take an example, SBI Magnum Medium duration fund. See below graph of their holding in terms of ratings.

Source : ValueResearchOnline

If you see any funds with more SOV & AAA rated holdings, it’s good and probability of going default is very less. Rating A & below is near to 10% -> Indicates the Fund credit risk.

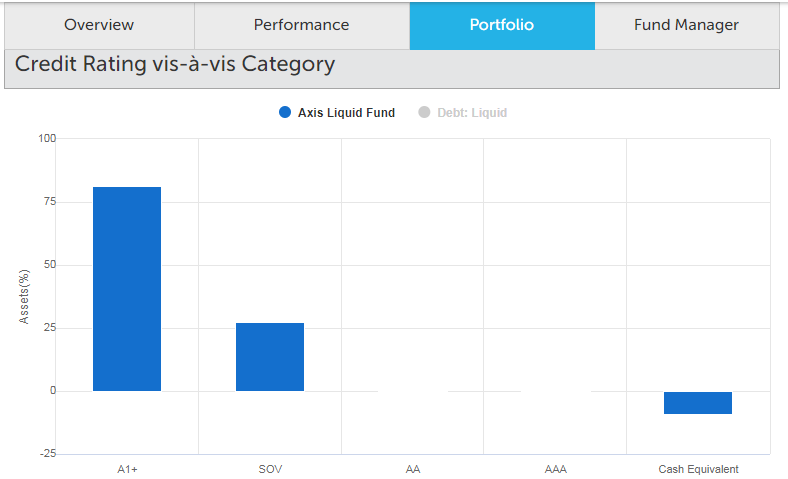

If you see the portfolio of any liquid funds, here I have taken Axis Liquid fund, the holdings will be mostly only in the highest rated bonds like SOV and AAA bonds.

These are just an another factor which investors should look for before investing in a debt funds.

Conclusion:

Credit ratings gives investors an overview between the risk and return in his investment decision.

So, Before Investing in any debt funds or other marker related instruments, look at the portfolio of the funds and decide yourself.

Happy Investing.