A Midcap equity fund is a mutual fund scheme that invests predominantly in Mid-cap equity stocks.

As per the Securities and Exchange Board of India (SEBI) circular no. SEBI/HO/IMD/DF3/CIR/P/2017/114 dated 6th October 2017, Mid-cap stocks are those that ranks from 101st to 250th company in terms of full market capitalization*.

*Market capitalization means total value of the company which is calculated by multiplying the CMP (Current Market Price) with the total outstanding shares of the Company.

In order to ensure consistency in the mutual funds investment universe for equity schemes in India, AMFI (Association of Mutual funds in India) will prepare the list of stocks every mutual funds would be required to adopt to invest in each category of mutual funds scheme.

Every 6 months AMFI release the data and all AMC would have to re-balance their portfolio within one month.

Are you looking for any below ?

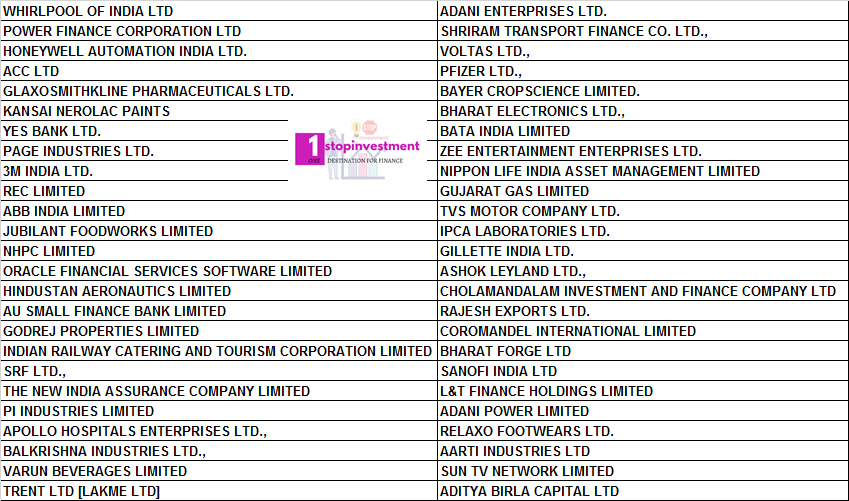

List of Mid-Cap Stocks

For the Halfyearly period Jan – June 2020 list, Below are the list of stocks which mutual funds would invest in Mid-Cap funds.

Eventhough the fund manager has to invest only in the list of above 150 stocks, there is no restriction in their portfolio holding pattern. As per SEBI, Minimum investment in equity & equity related instruments of mid cap companies- 65% of total assets. The role of fund manager and the fund performance lies here in portfolio allocation.

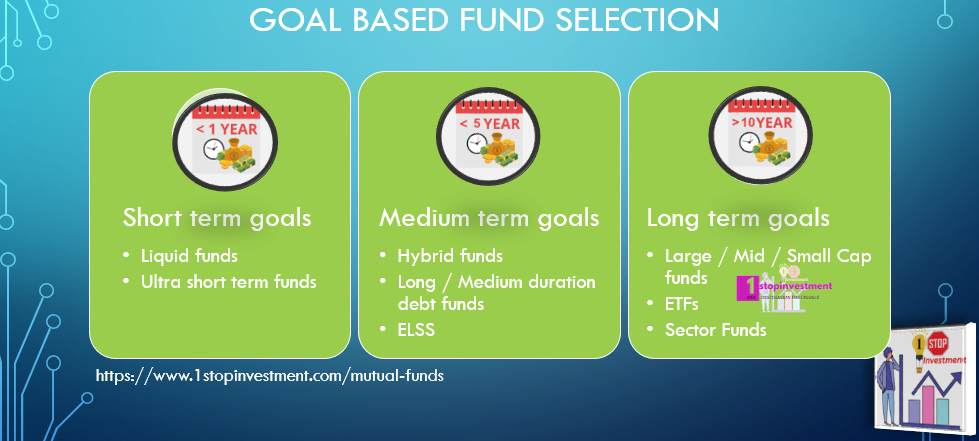

Goal-Based Investing

If you are selecting the funds based on your goals, then Mid cap funds are best suited for your long term goals. If the goal tenure is more than 10 years, then Mid cap funds may suit for the goal and if you are looking for shorter period, then Midcap funds may not be the best choice for investing.

Midcap funds are highly volatile and has its own Equity high risk associated with it. These midcap funds may outperform large cap funds and when the market plummets, these funds are not stable as large cap funds.

With the volatility in the market, the stocks in the Mid cap fund needs time to grow and for that growth, investor has to give the period of time and that’s why I feel goal based Investing is better while investing in mutual funds.

Ok! So, if you decided to invest in a midcap fund, you need to know few factors before investing in any funds.

Factors to keep in mind while selecting a Mid cap funds

The below few factors which I keep in mind while selecting a mutual funds.

The below are only a guidelines for selecting a fund who is DIY investors and read Disclaimer before taking any decision and if you are not comfortable with any filters, please comment it out.

Keep it Simple method. I use rather than complicating with any mathematical numbers like Sharpe Ratio, Standard deviation, Beta, etc.

Yes, the ratios and other numbers also helps but the basic filter should be there to select a fund to invest from the Mid-Cap category.

1. Know the Availablilty of Direct funds in the Category

From the Scheme data available in AMFI website, there are around 110 funds of Regular & Direct with Growth, Bonus and Dividend options.

From 110, Filtered out the Direct plans alone.

2. Survival Period

I am being a moderate risk taker, I would like to go with AMC who has been in the market for 5 years. As per you risk profile, you shall increase the period or decrease the period as you want.

Please see below list with completed years.

As per the risk profile of the Investor, Investor shall filter out. Here for the Analysis, I have filtered funds with more than 5 years experience.

3. Measuring Performance

The Historical performance of the fund gives investor a confidence to invest but it is not guaranteed that similar kind of returns are expected in the future. But It is one of the few metrics by comparing apple with apple concept. Here I have taken 1,3,5 year returns with the benchmark returns. Even longer period of return like 10 year also be taken for analysis.

Out of 21 funds, I am filtering the funds which has beaten the Benchmark atleast in one period.

5 Funds have outperformed the benchmark in all the period and other 10 funds also outperformed the index.

4. Assets under Management (AUM) Value

AUM is the overall market value of the mutual fund that the scheme holds in the market. AUM is the measure of how big the fund house in the category. Although, this number is just an another filter to choose with HIGHER AUM funds. Higher the AUM size means many investors have already invested in that fund. However, the AUM depends on the fund manager skill to deliver the good returns beating the Index.

Already the performance metrics been done, AUM based sorting shall be done to filter out the funds.

5. Expense Ratio

Expense ratios are less in Direct Fund and costlier in Regular funds. That’s why direct fund is the first filter I set.

I have taken the Expense ratio of the fund and average expense ratio in the category comes around 0.95.

I have taken 6 funds with Expense ratio less than 1.0% for further breaking down the analysis.

6. Fall over the Pandemic

Finally, we should not compare only the good time also in the worser period, how the drawdown has happened in the fund also to be seen. It gives better confidence in the Fund manager’s role.

Axis MidCap funds has the least drawdown comparing the other 6 funds. However DSP and Invesco sheds similar kind of drawdown in the above period.

Units allocation & Cut-Off Timings for Midcap Funds

If the order is placed before cutoff time (1pm), units allotted will be based on NAV of the same day.

If you placed after 1pm, units will be allotted based on the next day’s NAV.

Best Midcap Funds to Invest in 2020

Considering the analysis of AUM value, Expense ratio and Past Performance in all the Time Frames, Either AXIS , DSP or Invesco will be my choice of Investment.

In the Pandemic, AXIS has the least so, Axis Midcap Fund – Direct Plan – Growth will be best to look out in 2020.

Every 6months or 1year, Do the same analysis and Check your portfolio.

Happy Investing.