Hello Readers,

Fear or Risk of losing money which is not inevitable in trading and investing. So Any Investor / Trader needs to know how much risk he/she shall take before entering any trade.

Knowing the risk is what Risk Management tells. Risk Management helps investors and traders to cut down their losses by placing a suitable stop-loss.

“Always plan your trade before entering the trade”

Keep the above saying in mind always.

What is Planning the trade ?

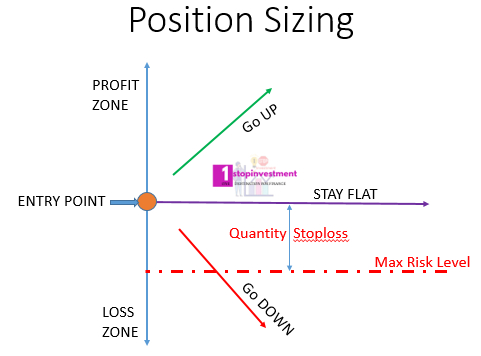

When you find an Entry signal to a trade, Don’t jump into the trade instantly. Just take a moment to plan the What if 3 conditions.

Fix the levels for all the three conditions from the entry point.

1, What if the price goes up,

-

- Either Book profit at certain levels (This is the Target Points) or

- Trail the stoploss to cost.

2, If it stays flat for a while , Adjust the Targets and SL accordingly.

3, If the price goes down, we need to suitable find a exit level where the loss could be bearable.

The reward from a trade is always indefinite and unknown potential. But The risk is the only first thing you should control about your trade.

Position Sizing

Position Sizing is nothing but the Quantity which you are buying / selling in the Entry point. One can not simply buy 1000 qty or 10000 qty without knowing how much he is going to lose if the trade goes against their view.

For Example, A Trader is having a capital of 5 Lakhs. In Each trade he is taking a risk of 5000Rupees and not more than that. So the Max Risk here is 5000Rs.

Now Either Stoploss of the trade or Quantiy of the trade has to be identified.

He is entering a trade at Rs 100 and with stoploss level Rs 90 where he finds Support for the stock.

Quantity will be 5000 (Max Risk) divided by 10 (Entry – Stoploss) Equals 500 Quantity.

A Simple Excel tool shall be change your trading style.

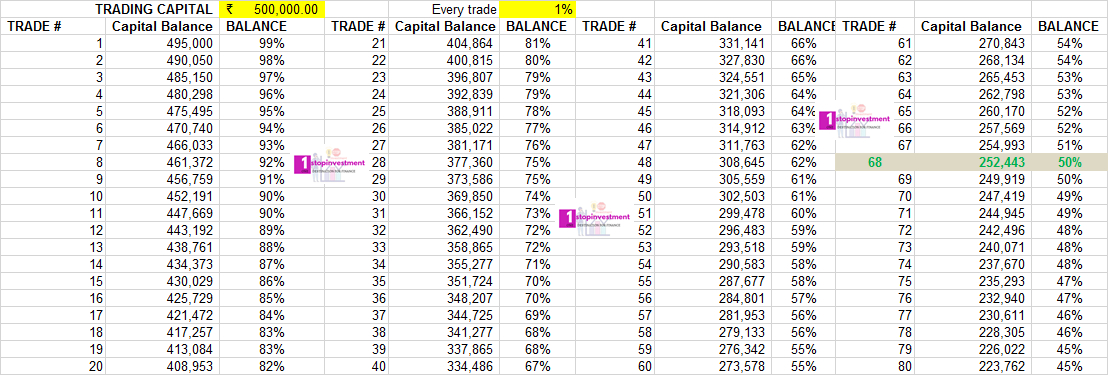

One Percent rule in Trading Risk Management

Many traders follow this so called the one-percent rule. Basically, this rule means that One should never risk more than 1% of your capital or your trading account into a single trade.

See below illustration and the reason why 1% rule is good. Even After 68 Continous losing trades, you will be lost only half the Capital.

Always take the Risk what you are affordable to take.

Conclusion

Risk Management is the least known area for the Investor or Trader.

To Stay on the Crease, Player should have the energy to Play. Likewise for Traders, Capital protection should be more important to stay on the trading.

“Plan the trade before entering and don’t change the plan once you entered the trade”

Happy Trading.!

Share your opinions on risk and money management with us and leave a comment below.