What is Dividend?

A dividend is the distribution of a portion of the company’s profits regularly among its shareholders which will be decided and managed by the company’s board of directors.

When a company earns a profit , they have 2 option. Either they will re-invest in the business (Earnings Retained) or pay a portion as a dividend to its shareholders.

Simply put, It is like small bonus for owning the stock.

Dividends to shareholders will be credited to their bank account not to their demat account.

Dividend is usually per share basis. i.e) Fixed amount per share.

Paying dividend to the shareholder is not the company’s expense.

Type of Dividend :

Dividends shall be Interim dividend or Final dividend.

- Interim dividend shall be announced during the First , Second and Third Quarter of the corporate earnings announcement.

- Final dividend shall be announced at the end of the financial year.

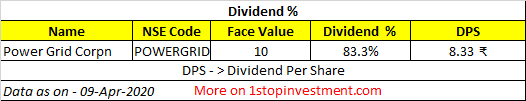

Dividend % :

Dividend is usually announced in percentage of the Face Value of the shares.

If a company X with shares Current Market Price at Rs100 and its face value (FV) is Rs10 and the company announces a dividend of 50% then it means the dividend would be 50% of Rs10 that is 5Rs. Per share.

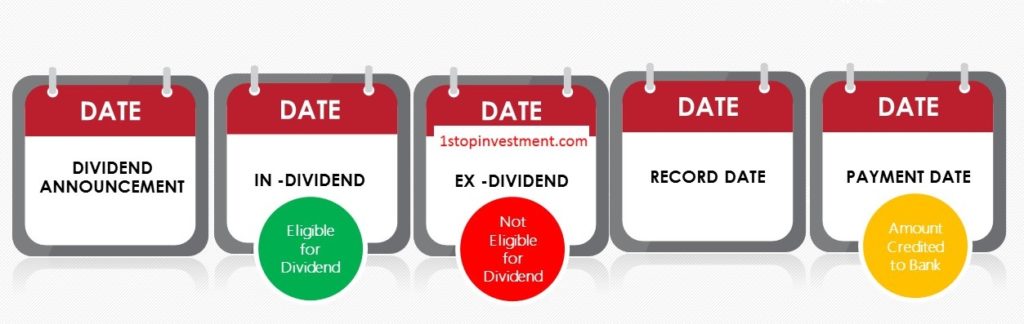

Important Dates to remember

1.Announcement / Declaration Date:

This is the date when the company announces its intention to pay dividend.

2.In Dividend Date:

This is the last date when Existing shareholders and whoever buys the stock on this date are entitled to receive the dividend. This is usually one trading day before the Ex-Dividend date.

On this day, you may notice that Company may trade larger than it’s usual volume.

3.Ex – Dividend Date:

On this date, only Existing shareholders are eligible to receive the dividend. Those who are buying on this date is not entitled to get dividend. That is Ex-Dividend Date.

On this date, you may notice that stock price will be decreased by the amount equal to dividend value.

Existing shareholder will receive dividend even if they sell their shares on this date.

4.Book Closure date or Record date

While announcing a dividend, company will announce a Date on which the company temporarily closes its books for fresh transfers of stocks.

Shareholders who are registered in the company’s record before the ex-dividend date are only eligible for dividends.

Record Date is the Next trade date from the Ex-Dividend date.

6.Payment date

On this date, amount will be credited to your bank account.

However, dividend income over and above ₹1,000,000 shall attract 10 % dividend tax in the hands of the shareholder with effect from April 2016.

Simple Illustration :

Happy Investing.

Continue Reading this also, How to look at the Dividend Yield as a Pro Investor and Guide to High Quality Dividend stock selection?

Join now with us on Telegram to get latest Dividend updates! Also,Get our latest news and daily updates on stock markets and many more. Join our Telegram channel here & LIKE OUR FACEBOOK PAGE.