Hello Trader,

So far, you always thought that futures and options were only high risk instruments to trade. So, how can there ever be a zero-risk F&O strategy.

In the Options trading, there is a Strategy with No Loss and minimum profit. But to have this position in real time, it is difficult. We will see more in detail in this post.

For Zero loss, you have to hedge the position against any movement of the underlying till the expiry.

There will be a time when the market is discounted much to its Index/underlying.

You have to be more vigilant to catch this action.

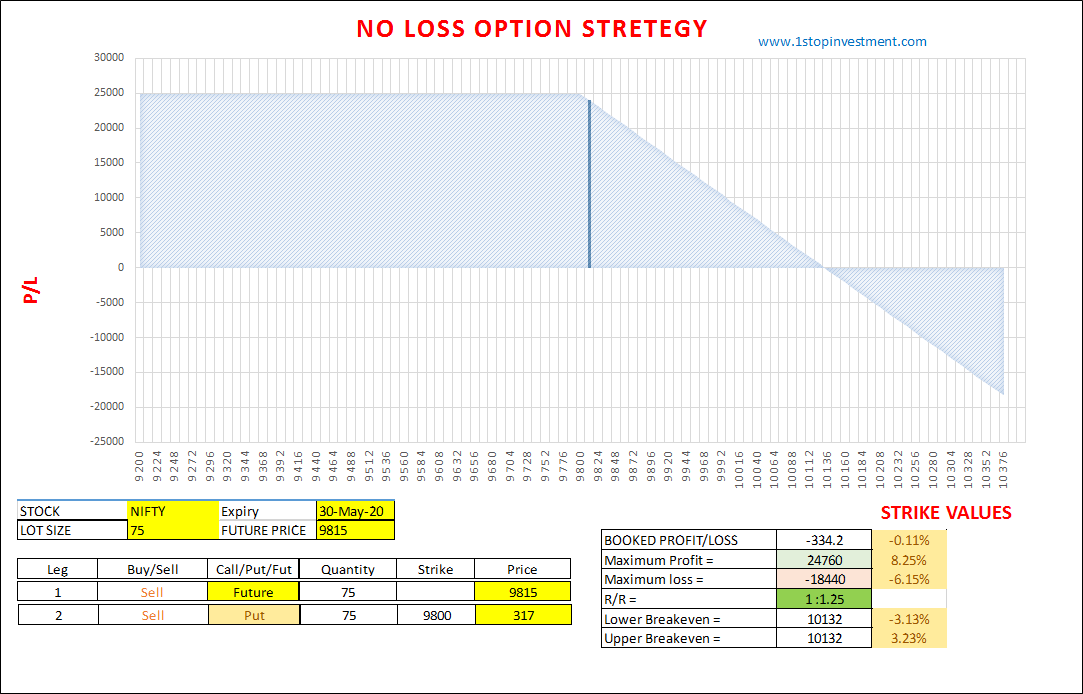

Let me explain with an example, I will explain with “Nifty” underlying.

Theorotical Stretegy would be involved with Futures also.

- Sell 1lot of Nifty Futures

- Buy 1 lot of Call at ATM

- Sell 1 lot of Put at ATM

Let me be more clear with Numbers and Position,

STEP / LEG – 1 :

The Trade has to be initiate with Selling the Futures and your Payoff graph will be like this.

Risk: Unlimited

Reward: Unlimited

STEP / LEG – 2 :

The Next position is to hedge the Trade with Selling the PUT option and your Payoff graph will be like this.

The Strike chosen here is ATM.

Risk: Unlimited

Reward: Limited

STEP / LEG – 3 :

The Next position is to Neutral the Trade with Buying the CALL option and your Payoff graph will be like this.

The Strike chosen here is ATM.

Risk: Limited / No loss

Reward: Limited (Minimum)

So, Yes there is a Strategy in Options Trading with No-Loss. But there are complications involved in this Strategy.

What are the complications involved in this Strategy ?

- Timing the Market is very difficult because most times the Discounted price is rare to catch.

- You need to factor in the brokerage and other statutory charges into your calculations when you actually create these zero risk strategies. Diazepam online http://www.pharmacynewbritain.com/valium

For this very minimum profit, why to adopt this Strategy?

During the End of the day, you may be in profit but doesn’t want to close the position (OR) during the long trading holidays, you may want to carry your end of the day position to reap max profits. So in that time, you may Hedge your position in the end of the day with this Strategy as applicable to you. So that you will be having tension free weekends without worrying about Market conditions.

Conclusion :

Always remember these things, Every trade is risky but when it is properly hedged you shall prosper in your trading.

This why I created this post, you may have seen in the 3 legs, how our risk is converted from Unlimited loss to Limited Loss.

Happy Trading.!!

In case if you are interested to buy the Options Payoff Graph Excel Spreadsheet for a fee, You can write an email to me here : mailto1stopinvestment@gmail.com

Also, Please Check out other tools available here !

Make some no loss strategy this isn’t so cool strategy